Va Tech Wabag Shares: Shares of Va Tech Wabag Limited (VTW) may rise by about 30 percent from the current level. Brokerage firm Axis Securities has made this estimate in a recent report. The brokerage has recommended ‘Buy’ on the stock and has given it a target of Rs 1700 per share. After this report, the shares of Va Tech Wabag rose by 4 percent during trading today on 12 September and the stock price reached Rs 1,425. Let us tell you that VA Tech Wabag is a multibagger stock, which has given a return of about 119 percent to its investors so far this year. At the same time, its stock has increased by more than 200 percent in the last one year.

Axis Securities said Va Tech Wabag is well positioned to take advantage of the growing opportunities in the field of water conservation and security. Government bodies around the world are now allocating more resources to water conservation and imposing stringent regulations on industrial waste. This change is leading to an increase in municipal and industrial expenditure. This is creating significant opportunities for experienced companies like Va Tech Wabag.

The brokerage said VTW has improved its business model in recent years, leading to improved profitability and cash flow. The company’s EBITDA margin is expected to exceed 13% in FY24 from around 8-9% previously.

Related news

Axis Securities said VA Tech Wabag is being strategically careful in selecting its projects. The company is focusing on reducing the share of construction in EPC contracts, increasing O&M revenue to 20%, increasing the share in industrial contracts and adopting modern technologies.

Apart from this, the company has sold its stake in many of its low-margin associate firms in Europe. This helped the company to increase its EBITDA margin, which reached 13.2% in FY24. The company aims to maintain the margin at 13-15% in the next few years.

Strong revenue growth

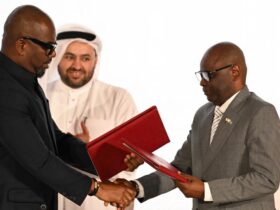

VTW’s order book is around Rs 10,676 crore as of June 2024. This includes a Rs 2,700 crore desalination plant project in Saudi Arabia. The company has set a target to take its order book to Rs 16,000 crore by FY 2026. It expects to get big projects from Middle East countries and better margins. The current order book indicates that revenue growth will remain strong for the next 3-4 years.

Read this also- HDFC Bank has a big plan, for this reason it is preparing to sell loans to the world’s leading banks including ICICI Bank

Leave a Reply