Vodafone Idea Shares: Vodafone Idea’s share may fall by 83% to Rs 2.5. You must have heard this headline too. This headline was made on a report by the world’s renowned brokerage firm Goldman Sachs, in which it advised to sell Vodafone Idea’s shares immediately. But the special thing is that this Goldman Sachs had bought shares worth crores of rupees as an anchor investor in Vodafone Idea’s FPO. That is, on one hand it is advising to sell the shares and on the other hand it is itself buying shares worth crores. What is this whole mess? It is also being said on social media that some big brokerage firms are trying to play games in Vodafone Idea? What is the reality of all these claims, we will talk about this in today’s video. So let’s start the video

Goldman Sachs released a report on Vodafone Idea on September 6. In this report, it advised to sell Vodafone’s shares once again. The brokerage said that the company has recently raised funding through FPO and other means, but this will not help in stopping its declining market share. Goldman Sachs said that Vodafone Idea’s rival companies are spending 50 percent more than it to expand their business. Due to this, Vodafone Idea’s market share may decline to 3 percent in the next 3-4 years.

After this report, Vodafone Idea’s shares fell by 14 percent in the market. There was panic in the market and investors started selling their shares. But then some smart investors on the internet searched the documents of Vodafone Idea’s recent FPO (Follow-On Public Offer) and found out that Goldman Sachs itself had bought 81.83 lakh shares as an anchor investor in this FPO.

Related news

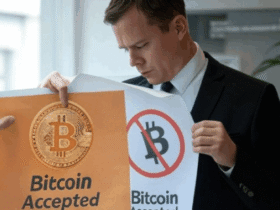

Now the question arises that how is this possible? On one hand Goldman Sachs is saying that the condition of VI is bad and on the other hand the same Goldman Sachs is buying its shares. Is this a game? Or is there something wrong here?

So let’s know the secret behind this. Actually, the investments we see in the name of Goldman Sachs are not necessarily its own money. Actually, many foreign investors want to invest in the Indian markets, but they do not want to go through the hassle of registering themselves as FPI (Foreign Portfolio Investor). In such a situation, they invest through ODIs i.e. off-shore derivative instruments. They take these ODIs from an already registered FPI, who invests on their behalf.

Goldman Sachs also acts as an FPI for its clients and helps them invest their money in the Indian stock market. This means that when they participated in Vodafone Idea’s FPO, they were buying shares for a client and not for themselves. A Goldman Sachs spokesperson also said that its investment banking department and stock research department are completely separate and work independently.

This matter is not limited to Goldman Sachs only. A similar thing has been seen with Switzerland’s leading brokerage firm UBS. UBS had bought about 4.45 crore shares of Vodafone Idea in the FPO through its two funds. These shares were bought at a price of Rs 11. After this, UBS released a report that it is very bullish on Vodafone’s stock and has given it a target price of Rs 19 with a ‘Buy’ rating. But just 2 days after this report, UBS funds sold Vodafone’s shares at around Rs 15.50.

All these things tell us that whenever big investment or brokerage firms invest in a stock, it does not always mean that they are completely confident about the future of that company. Sometimes they trade only for their clients, and the opinion of their research department may be completely different from that. Therefore, it is important to understand every news of the stock market carefully.

Read this also- Why did the stock market suddenly rise? 3 big reasons; Know how the trend can be tomorrow on 13 September

Leave a Reply