Key facts:

This confirms that BNY Mellon can now offer custody of BTC and ETH, as anticipated.

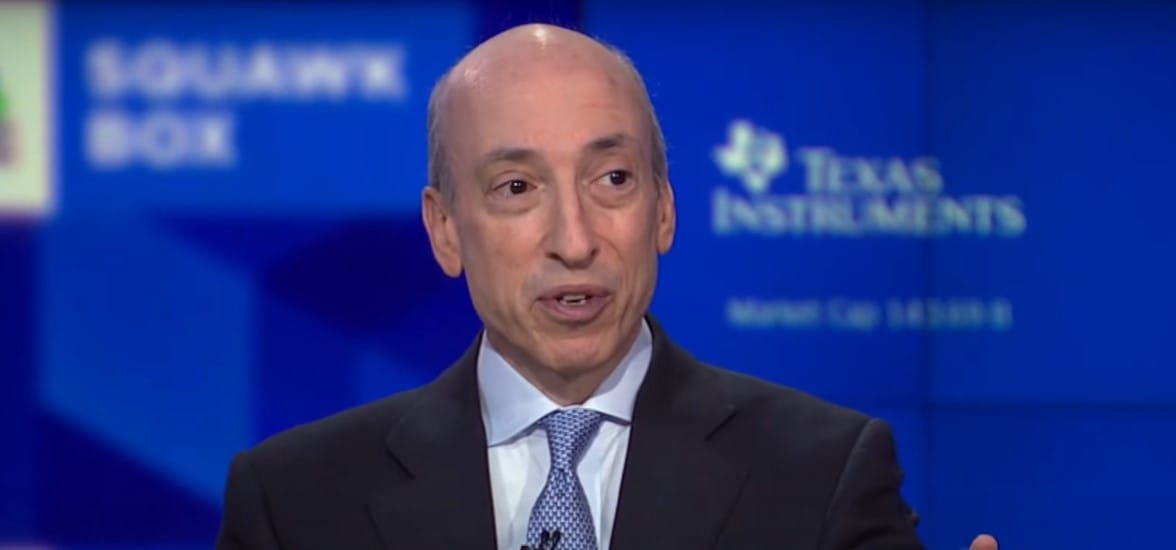

Gensler said there are entities presenting plans to custody digital assets.

BNY Mellon received the green light from the Securities and Exchange Commission (SEC) to custody bitcoin (BTC) and ether (ETH) beyond exchange-traded funds (ETFs), SEC Chairman Gary Gensler confirmed. in an interview this Thursday, September 26.

Earlier this week, BNY Mellon said the SEC provided a “no objection” to its ETF custody plan, a regulatory term that indicates the bank can operate safely. since its structure will not violate the agency’s requirements to reflect the value of digital assets on its balance sheet.

Gensler detailed that BNY Mellon plans to use individual bitcoin and cryptocurrency wallets, each with a separate bank account, prohibiting mixing assets. “It is up to the bank to decide whether to expand the set of digital asset use cases that it feels comfortable custody,” Bloomberg reports.

The chairman of the SEC thanked BNY Mellon for the “preliminary work” on how to ensure that clients’ assets remained theirs and were not sidelined in the event of bankruptcy. This is relevant, especially after thousands of cryptocurrency traders have been affected by the bankruptcy of platforms such as Celsius Network, FTX, Voyager Digital and others. Gensler indicated that this bank, or any other with a similar structure, would get the same “no objection” from the SEC.

Furthermore, Gensler mentioned that several banks and brokers have discussed digital asset custody structures that would segregate clients’ assets, potentially allowing them to avoid the requirements of Staff Accounting Bulletin 121 (SAB 121), the measure that establishes the SEC’s balance sheet requirements for cryptocurrencies. This rule has been subject to criticism; and as part of this, a group of 42 Republican congressmen asked Gensler for his annulment, as reported by CriptoNoticias.

The announcement by the president of the regulatory agency follows BNY Mellon’s statement that it would custody BTC and ETH ETFs, as reported in CriptoNoticias this week. BNY Mellon’s ability to custody digital assets beyond ETFs, marks a milestone in cryptocurrency integration in the traditional financial system, expanding the reach of financial institutions in the cryptocurrency market.

This article was created using artificial intelligence and edited by a human Editor.

Leave a Reply