The summit brings together 20 thousand attendees from 33 countries, who discuss their geopolitical challenges.

The BRICS are looking for alternatives to the dollar, while Putin rules out the viability of a single currency.

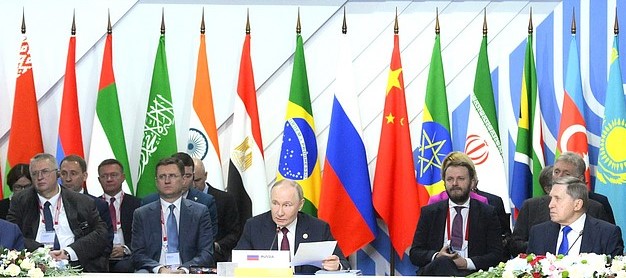

The 16th annual BRICS summit, being held in Russia for the first time in nine years, opened yesterday with a speech by Russian President Vladimir Putin followed by a closed-door meeting. Later, the event, which runs until tomorrow, will have an expanded meeting that will be open to the media.

The main objectives of the BRICS are international economic and financial cooperation, the discussion of global political issues, the exchange of experiences and the development of joint projects in science, technology and energy.

However, although it does not appear explicitly on the agenda, the issue of dedollarization and the decisions that can be made around it have been attracting attention of the entire world.

In fact, the mayor’s office of the capital of Tatarstan, venue of the meeting, rated the summit as “the beginning of a new world in the heart of Kazan, the ancient city.”

There is no doubt that the Summit is a historic event taking into account that some 20,000 guests from 33 countries attend, including 20 high-ranking state officials. In addition, there are heads of important international organizations, including the Secretary General of the UN, Antonio Guterres.

As previously reported by the Kremlin press service it is planned to discuss with greater emphasis on current international problems regarding the aggravated situation in the Middle East and the interaction of the BRICS countries and the Global South in the interests of sustainable development. And according to Reuters, at the Summit Russia will try to convince the BRICS countries of the need to advance de-dollarization.

It is indisputable that de-dollarization is at the center of the debate, and by virtue of this we can look at the role that the BRICS are playing in a possible paradigm shift of the global financial system in three keys:

1. Can the BRICS really drive global de-dollarization?

The narrative emerging from the BRICS bloc has renewed interest in the future of the US dollar as a global reserve currency. In fact, the alliance of countries has already begun testing a payment system without dollars. This, while the US currency has begun to disappear from trade between the countries of the bloc.

However, for some economists such as the renowned Paul Krugman, what has been said about possible de-dollarization is nothing more than “much ado about nothing.”

Krugman, winner of the 2008 Nobel Prize in Economics, noted in an article last year that the dominance of the dollar will remain intact and that there is no real alternative to the US currency. Like him, there are other analysts who see the rise of economic initiatives such as those that are emerging from BRICS as a failed effort that lacks substance and they will be able to do nothing about global de-dollarization.

However, analysts such as Mohamed El-Erian, former deputy director of the International Monetary Fund, warn that The dream of alternative dollarization is underway and must be taken seriously.

In your recent articleEl-Erian points out a notable phenomenon: the price of gold has seen a 40% increase in the last year, even though inflation has decreased. This shift suggests a move toward safer assets, possibly in response to geopolitical tensions and the perceived vulnerability of the dollar.

What is happening in itself is that the countries of the BRICS alliance are taking concrete steps towards a multipolar financial system. The central banks of these nations are increasing their gold reserves and exploring ways to de-dollarize their own economies.

The geopolitical context also plays a crucial role today. The economic blockades and sanctions imposed by the United States on countries such as Russia have prompted these nations to seek alternatives to the existing financial system.

The creation of a new Development Bank by BRICS and the intensification of trade in local currencies are examples of the efforts of these countries to restructure the global financial order.

What is on the ground is that new actors, such as the BRICS, are beginning to challenge the current global order, and actions in the monetary and geopolitical sphere suggest that we are witnessing a profound and prolonged change.

Time will tell if these initiatives will ultimately give rise to a new financial paradigm or if the dollar will remain the undisputed king of currencies.

2. Why is there so much attention about possible de-dollarization agreements that may emerge at the Brics Summit?

The BRICS, founded in 2006 as a group of investment strategies for emerging nations by Brazil, Russia, India and China, has since expanded and now includes South Africa.

As of January this year, BRICS has seen the integration of Iran, Egypt, Ethiopia and the United Arab Emirates, while Saudi Arabia has yet to confirm its membership, while 30 other nations have expressed interest in becoming members, including the candidates for the European Union, Serbia and Türkiye.

It means that now The BRICS group comprises 45% of the world’s population and 35% of its economy, according to purchasing power. Therefore, all the movements they make and those that may arise from the current Summit are important for the rest of the planet.

In fact, it has already been recognized by the United Nations (UN), whose deputy spokesperson for the Secretary General, Farhan Haq, pointed out yesterday that the BRICS countries “represent approximately half of the world’s population” and that the Summit has “great importance for the work of the United Nations.”

“It is an association of states [Los BRICS ] who work together on the basis of common values, a common vision of development and, most importantly, the principle of taking into account the interests of others.”

Vladimir Putin, president of Russia.

In short, the BRICS’ attempt to de-dollarize, that is, replace the US dollar as the currency of global foreign trade, could be very present in the minds of the leaders of the Western world.

The alliance itself denies that this is its objective, and affirms that it simply wants to promote greater trade in local money and currencies, but the reality is that there are multiple indications that the countries of the alliance definitely seek to promote changes in the established world order. So hence the great interest that the world has in knowing more about the progress of the BRICS with respect to de-dollarization.

3. Dedollarization, a challenge for the BRICS

As the BRICS evaluate alternatives to strengthen their international trade, the idea of a single currency has always been on the table. However, Putin said that the creation of a single currency for the BRICS countries has not yet been considered.

«As for the BRICS single currency, at the moment we are not considering this issue, it is not mature, we must be very careful, we must act gradually and slowly. We are currently studying the possibilities of expanding the use of national currencies and creating tools that make that work secure. We, as I already mentioned, are considering the possibility of using electronic tools; “That work is already underway.”

Vladimir Putin, president of Russia.

Putin added that the creation of a single currency for the BRICS will be an issue that will be raised again in the future. Given this, several Russian economists debated the challenges faced by the alliance regarding the possibility of trading with its own currency, other than the dollar.

One of the main obstacles they see is the economic diversity that characterizes the member countries. Each nation presents a different economic panorama, with variations in levels of development, monetary policies and inflation rates. This raises a titanic challenge for the BRICSwhich should unify their economies under a single monetary system, something that could destabilize even the strongest economies in the bloc.

Besides, Russian economists They see that political conflicts between some members, particularly between China and India, further complicate the possibility of establishing a common currency. Historical tensions and territorial disputes do not facilitate the cooperation necessary for a project as long-term as that of a single currency.

Unlike the European Union, where political and economic integration has been a fundamental pillar of the creation of the euro, the BRICS lack a similar level of cohesion. This lack of integration represents a new barrier which could hinder any attempt to implement a common currency.

Faced with these challenges, economists have begun to explore alternatives that could be more viable. One option is to develop integrated payment systems that allow direct transactions between the national currencies of each country, increasing efficiency and resistance to international sanctions.

The possibility of continuing trade using national currencies is also being considered, which would allow reduce dependence on the US dollar and other reserve currencies.

Leave a Reply