Calling self-custody “cryptoanarchism” simplifies what Bitcoin accomplishes, Mallers said.

Even the co-founder of Ethereum, Vitalik Buterin, came out to question the founder of MicroStrategy.

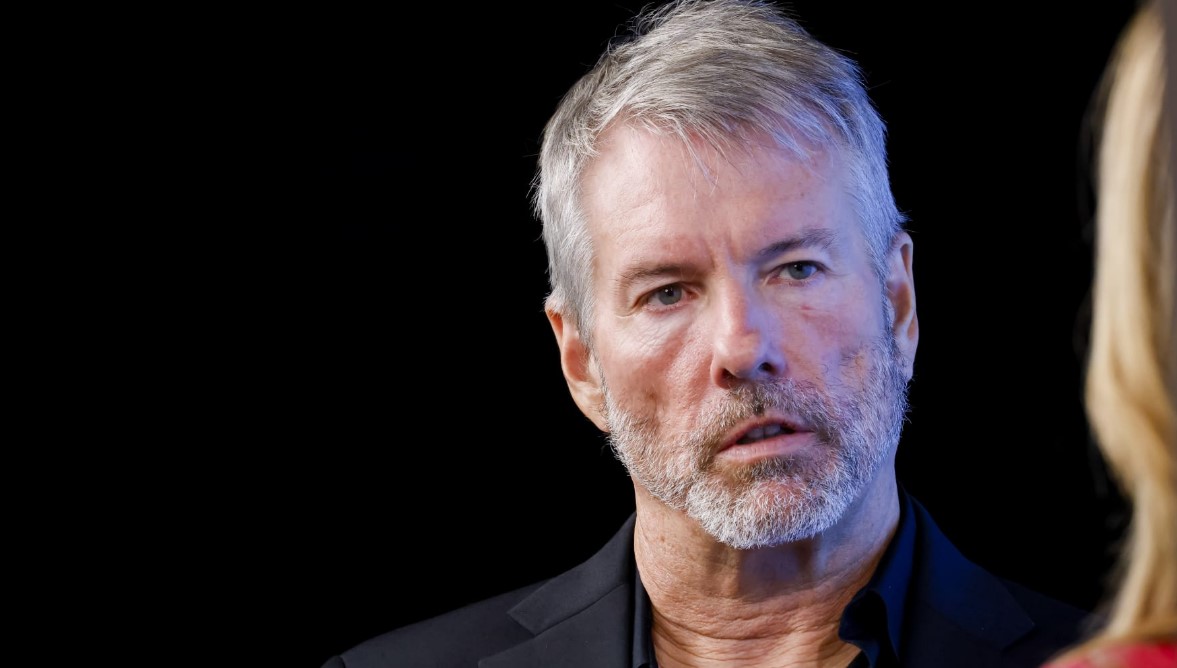

The CEO of MicroStrategy, Michael Saylor, is under the critical eye of some bitcoiners, this after the businessman stated in an interview that the self-custody of bitcoin is comparable to the paranoia of cryptoanarchists, who believe that traditional banks can confiscate and control their holdings.

According to Saylor, those who think bitcoin funds can be confiscated if are in hands of large companies and corporations, as well as banks, are “paranoid cryptoanarchists” because it is “a myth and an allegory that is repeated over and over again.”

This is in reference to the Great Depression of 1973, when the Treasury Department was authorized by executive order to dispose of the gold currency of the United States, which It was a step towards demonetisation of gold and liberalization of the gold market.

Saylor clarifies that the gold was not confiscated: “People handed over the gold voluntarily. They (the government) didn’t go kicking in everyone’s doors to arrest them, shoot them and take their gold. None of that happened.”

So, for him, there is no risk that corporations, like his, are the ones holding large amounts of BTC. This, remembering that MicroStrategy is, right now, the largest public company to accumulate bitcoinwith more than 250,000 coins, according to Bitcoin Treasuries data.

“I think when BTC is guarded by a bunch of crypto anarchists who are not regulated entities, who don’t recognize the government or don’t recognize tax or reporting requirements, that increases the risk of seizure. In the end you have an ‘OG crypto community’ that is intense about it, but 99.99% of the money is in the traditional economy,” he said.

Tremor in the Bitcoin community

Those comments from Saylor ignited the most prominent bitcoiner maximalists. They did not hesitate to present their arguments. against who represents one of the largest bitcoin whales on the market.

Via X, personalities such as Jameson Lopp, Max Keizer, Jack Mallers and others, they questioned Saylor’s comments about personal custody of bitcoin. Some even described them as “crazy” and clarified that beyond being an investment issue, it is part of what Bitcoin needs to strengthen and improve.

According to Lopp, who has been one of the most prominent Bitcoin developers in recent years, Bitcoin self-custody it is not about just being a “paranoid cryptoanarchist”. As the computer scientist sees it, convincing people to trust external custodians “has many negative long-term ramifications.”

Among those implications is, for example, that centralizing currencies in a few hands “increases the systematic risk of loss and confiscation”, which deprives bitcoiners of participating in governance activities such as running nodes or exchanging forks, Lopp notes.

Additionally, Lopp says, ossification arguments are strengthened because institutions don’t care about more advanced cryptographic features, and permissionless scalability loses priority, since it can only be achieved through promissory notes from trusted third parties.

Thus, the bitcoiner concludes, “self-custody is not only important for individual bitcoin holders, but also for the strengthening and continuous improvement of the entire network.”

It is not “cryptoanarchism”

More assertive opinions were those shared by Max Keizer, another maximalist bitcoiner and director of the National Bitcoin Office of El Salvador, who consider that greater adoption by larger players “attracts more desperate nocoiners with their pay-to-play regulators.”

“If you don’t prioritize self-custody you are a degenerate shitcoiner. And everyone should do everything they can to ensure that self-custody is not pursued by any powerful entity, because without self-custody, bitcoin is not peer-to-peer, permissionless, or censorship-resistant, and those are necessary attributes for be valuable. Pursuing self-custody is a violation of human rights.”

Max Keizer, maximalist bitcoiner.

Jack Mallers, maximalist bitcoiner and CEO of the bitcoin payments platform Strike, was emphatic when defend self-custodynoting that calling that practice “cryptoanarchism” “oversimplifies” what bitcoin achieves.

Mallers thus reminds us that self-custody “is about freedom.” “Freedom of expression, property rights and the protection of your right to own what is yours. We should not dismiss it because freedom is not promised: we must fight for it and protect it,” he emphasized.

Adam Back, cryptographer and one of the greatest references in the Bitcoin ecosystem, went further on the issue of self-custody and directly referred to BTC spot exchange-traded funds (ETFs), which, in essence, are large entities with a huge amount of bitcoin, such as those advocated by Saylor.

For Back, investing in these entities, which together accumulate almost 1 million bitcoins, “is the same as having shares or a bank balance.” This means that a court order “can seize” those assets. So, clarified that an ETF is not a protection.

Back added that “asset protection also exists in commercial finance, with structures to shift liability to frivolous court cases and ensure due process with forfeiture laws.” He then added that: “bitcoin simply lowers the barrier to entry for using asset protection (establishing and maintaining such structures costs professional and maintenance fees).

The impact of what Saylor said was so great that even the co-founder of Ethereum, Vitalik Buterin, came out to question it. For this computer scientist, the businessman’s comments “are crazy.”

“He appears to be explicitly advocating a regulatory capture approach to protecting cryptocurrencies,” he noted. “There is a lot of precedent for how this strategy can fail, and to me that is not what cryptocurrencies are about,” Buterin said.

The debate around self-custody thus becomes a metaphor for the broader ideological battle within the bitcoin space: between those who see BTC as a tool for individual empowerment and those who see it as another asset class. that must be managed by established financial mechanisms.

As Bitcoin matures, this tug of war between centralization for security and decentralization for freedom is likely to intensify, shaping not only the technology, but also to social values that must be defended in an increasingly digital world.

Leave a Reply