Dalio cites the cases of the United States and China, although he excludes Germany.

His statements come within the framework of Abu Dhabi Finance Week (ADFW).

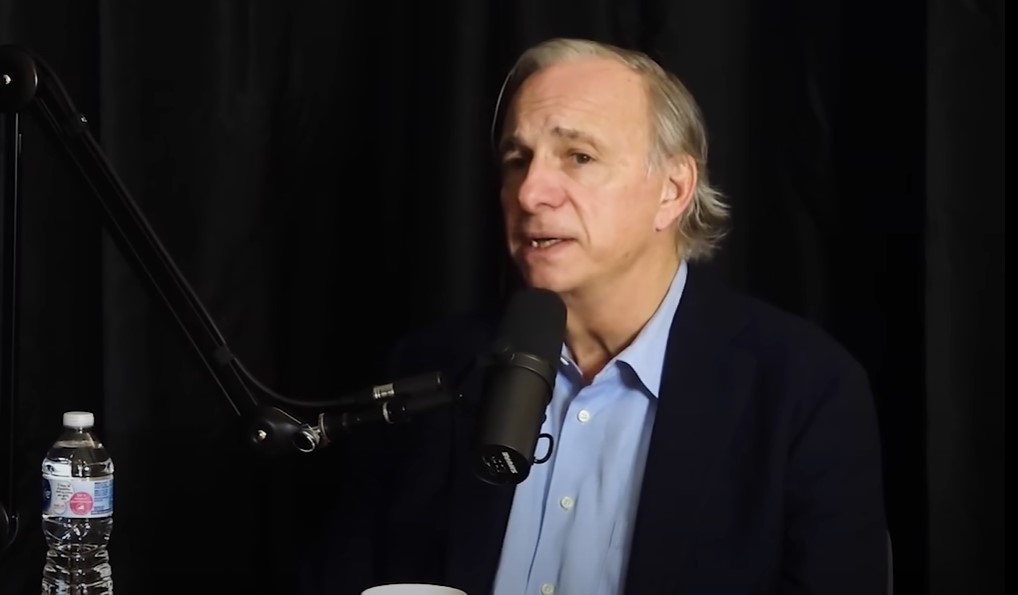

Billionaire Ray Dalio, founder of the hedge fund Bridgewater Associates, took advantage of Abu Dhabi Finance Week (ADFW) to warn about current debt levels, which he considers unprecedented; In addition, he stated that he wants to invest in solid assets, such as bitcoin (BTC) and gold.

“I want to move away from debt assets and into some hard money, like gold and bitcoin,” commented Dalio in his speech. He also highlighted that debt levels in countries such as the United States, China and other major economies, except Germany, have increased significantly. For the analyst, it is inevitable that these nations will face a serious debt crisis in the coming years, which will cause a drastic loss in the value of money.

“It is impossible for these countries not to have a debt crisis in the coming years that leads to a huge decrease in the value of money… Debt, money and the economy will drive almost everything,” the investor said.

Thus, the founder of Bridgewater – although he renounced control of the company in 2022 – explained that prefers to invest in companies that use disruptive technology to improve their operationsinstead of doing so in those that simply sell the greatest number of products or services. This philosophy reflects its interest in businesses that can leverage innovation to grow sustainably.

There is no need to obsess over the ups and downs reflected in the daily headlines. Instead, think more about the big forces. You have to think strategically and tactically, recognizing that what you don’t know about the future is more than what you already know.

Ray Dalio, founder of Bridgewater Associates.

It is important to note that Dalio did not always have the same stance regarding the leading cryptocurrency. In a 2017 interview, the businessman qualified Bitcoin as a bubble and considered it highly speculative.

Nevertheless, The COVID-19 pandemic accelerated the accumulation of global debtwhich led investors and savers to seek safer havens for their capital. Unlike traditional currencies, whose supply can expand unlimitedly, bitcoin emerged as an even more alluring alternative.

In fact, by 2021 Dalio was showing signs of having changed his mind, arguing that he owned some bitcoin and that in a high inflation environment he preferred to hold BTC over bonds. The latter was reported by CriptoNoticias.

Leave a Reply