The American company reached more than 70% performance in 2024.

Saylor anticipated the acquisition, while BTC dropped 13.7% in recent days.

MicroStrategy, the computer services company recognized for its aggressive investment strategy in bitcoin (BTC), made its 51st purchase by adding 2,138 new coins to its portfolio, with an investment of about $209 million.

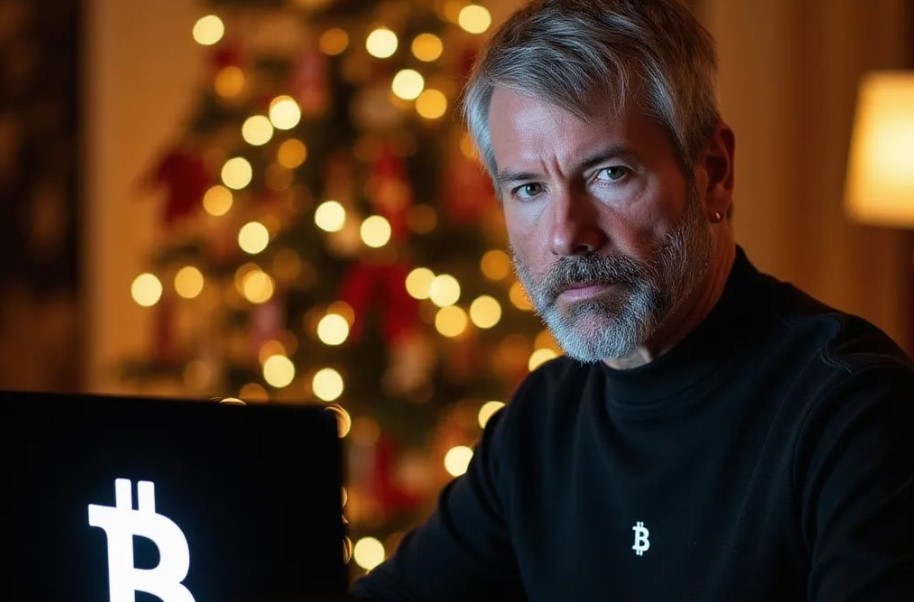

The information was announced today by its executive president, Michael Saylor, who detailed that This last acquisition was made at an average purchase price of 97,837 for each bitcoinbringing the company’s total holdings to 446,400 BTC. This with an accumulated investment of approximately $28 billion and an average purchase cost of $62,428 per BTC.

With this acquisition, MicroStrategy closes the year 2024 consolidating not only as the company with the most bitcoin in its treasury, but also as one of the main whales in the ecosystem. As such, the company’s history now shows 51 purchases since September 2020, with only one sale recorded. Of these, 45 have resulted in gains and only the most recent 5 in losses, reflecting Saylor’s confidence in the long-term potential of the digital currency.

Saylor anticipated on Sunday the step that MicroStrategy would take when shared on X An updated chart of the company’s holdings and earnings, revealing what could be purchase number 51. In this context, the price of bitcoin has fallen 13.7% in the last 12 days to close to $91,000, according to tradingview data.

Additionally, the Fear and Greed Index, an indicator that tracks market sentiment towards bitcoin, fell to October levels, recording a score of 65 on its last update. However, Corporate interest persists in integrating bitcoin into their reserve portfoliosas highlighted by Mike Belshe, CEO of Bitgo, a company that offers financial services with cryptocurrencies.

In a recent CNBC interviewBelshe spoke of the growing interest that companies have in integrating bitcoin into their treasuries, following in the footsteps of MicroStrategy. He highlighted that even if only a fraction of the hundreds of billions of dollars available on the balance sheets of large companies were invested in BTC, this would represent a significant success for the cryptocurrency industry. “It just makes sense,” he added, referring to the use of the digital currency as a hedging strategy against inflation.

Despite these positive prospects, the corporate world, as Belshe describes it, which is beginning to become evident with more and more companies following the MicroStrategy model, has not uniformly adopted this strategy. Other large companies, such as Microsoft, have rejected similar proposals, preferring to maintain their traditional investment strategies.

In any case, this contrast reflects an industry in transition, where Business adoption of bitcoin is still in its early stagesbut with clear signs of growing interest and a potential paradigm shift in corporate treasury management.

Leave a Reply