In his campaign, Trump promised to make the US “the cryptocurrency capital of the world.”

Its measures, focused on deregulation and tax cuts, benefit crypto assets.

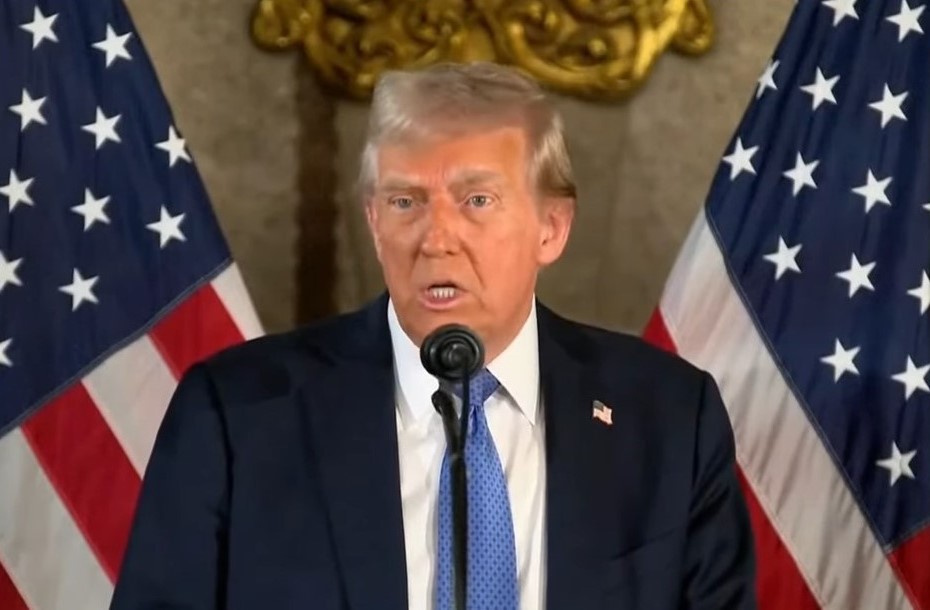

On January 20, Donald Trump will be inaugurated as the 47th president of the United States. The day, following the country’s traditions, will begin with a procession to the Capitol for the respective inaugurations, and will end with an inaugural parade down Pennsylvania Avenue towards the White House.

In the midst of the election campaign, Trump highlighted as one of his main proposals the project of Wyoming Senator Cynthia Lummis, which proposes the creation of a strategic reserve based on Bitcoin. This has strengthened the confidence of many that 2025 will be a key year for cryptocurrencies.

Mindful of the challenges the crypto asset sector faced during Joe Biden’s administration, particularly under Gary Gensler’s tenure at the Securities and Exchange Commission (SEC), Trump appointed David Sacks as “AI and cryptocurrency czar.” » of his government, committing to implement more open and clear policies.

On December 17, Cynthia Lummis expressed via X that “2025 will be the year of Bitcoin and digital assets,” and praised Sacks’ incorporation into the new government.

What can Bitcoin expect once Trump takes office? Various experts have already shared their perspectives. Hunter Horsley, CEO of Bitwise, expressed on the social network X that, if the president’s policies facilitate mergers and acquisitions, large companies could consolidate even more.

This scenario would highlight the relevance of cryptocurrencies, whose fundamental premise is not to depend on large institutions to protect individual interests. According to Horsley, this approach would accelerate the adoption of cryptoassets, making 2025 a big year for the sector.

For his part, Ripple CEO Brad Garlinghouse attributed the post-New Year optimism in the cryptoasset market to Trump’s proposals – at the time of writing this article, bitcoin has a price of USD 99,282 per coin. According to Garlinghouse, 75% of Ripple’s vacancies are now in the United Statesmarking a major shift compared to the past four years, when hiring was primarily focused internationally.

Furthermore, Garlinghouse highlighted that since Trump’s victory, Ripple has closed as many business deals in the United States as in the previous six months. According to the executive, this is a direct result of the greater trust generated by the president-elect. This is how he expressed it in X.

The hope surrounding Trump’s promises has also found an echo in Europe. Politicians such as the German Christian Lindner have warned that the continent must not lag behind in the adoption of cryptoassets. In particular, Lindner has proposed that European central banks, such as the ECB and the Bundesbank, consider integrating Bitcoin and other cryptocurrencies into their reserves, following the US lead in case Trump manages to implement his proposals.

Although these perspectives focus more on the long term, some look at what could happen in the coming days. Recently, Markus Thielen, founder of 10x Research, published a report in which he recalled that market dynamics continue to be linked to the policies of the Federal Reserve. Thielen foresees a positive start for the market in January, thanks to the inflation data from the Consumer Price Index (CPI) – which will be published on the 15th – but warned that this momentum could lose steam as the Federal Open Market Committee (FOMC) meeting approaches.which will take place on the 29th of this month.

Bitcoin’s relationship with the FOMC decisions is not exactly uncomplicated. It is worth remembering that, after the meeting on December 18, in which the Federal Reserve adjusted its expectations of rate cuts for 2025, going from five to two, the cryptocurrency suffered a considerable drop… It ended up losing almost 15% of its value and fell to around USD 92,800.

Thielen predicts that, although inflation could decrease in 2025, the Federal Reserve will take its time to adjust policies accordingly.

It is important to note that there are also skeptical voices regarding Trump’s commitments. Arthur Hayes, former CEO of BitMEX, believes that The president will not have the time necessary to generate substantial changes –Of course, he also embraces the possibility that he could be wrong. According to Hayes, when the market realizes this and adjusts its expectations, a major correction could occur.

In turn, Saifedean Ammous, advisor to the government of El Salvador, expressed in August 2024 that Trump’s promises are nothing more than empty allegations. According to Saifedean, The creation of a strategic reserve in BTC would imply a direct confrontation with the Federal Reservesince it could prompt people to part with their dollars in favor of the leading cryptocurrency. This, in the words of the financial specialist, “is not something that Trump or Kennedy are willing to do.”

Deregulation and support policies for cryptocurrencies have generated high expectations in terms of prices and greater adoption, but it is important to consider that Economic and political challenges will continue to affect market developments. Although the growth prospects for Bitcoin in 2025 are promising, a good part of its performance will depend on how Trump’s promise materializes and the reactions of key actors, among which the Federal Reserve and international central banks stand out. Ultimately, it will be essential to closely monitor the development of events.

Leave a Reply