The US Securities and Exchange Commission sued Elon Musk on Wednesday for failing to disclose his acquisition of Twitter shares before buying the company.

The SEC said Elon Musk violated securities law by acquiring Twitter shares at “artificially low prices.”

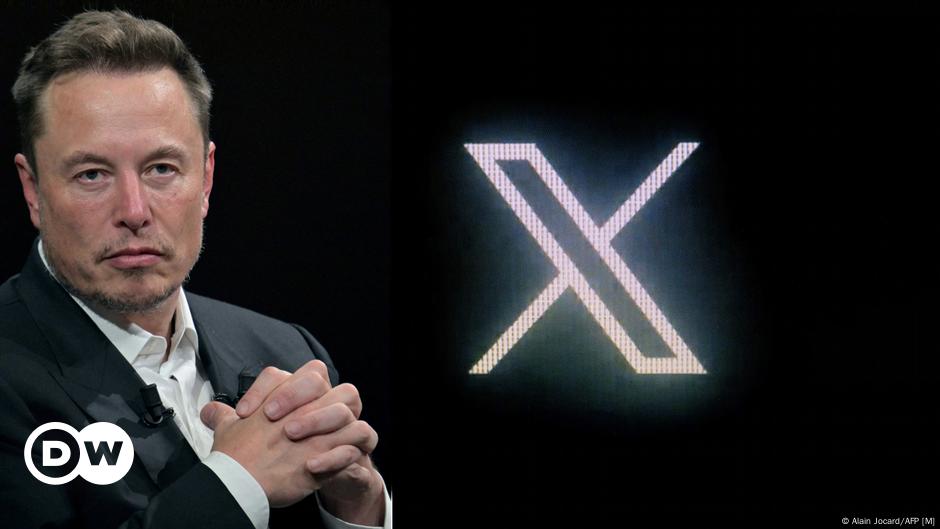

Musk bought Twitter for about $44 billion (€42.7 billion) in 2022, changing the name to X the following year.

What does the SEC say in its lawsuit?

The SEC alleged in the lawsuit that Musk committed securities fraud by acquiring an active stake in Twitter in 2022, but withheld the information.

Before purchasing Twitter, Musk held more than a 5% position in the company, which required him to disclose his stake to the public.

“Defendant Elon Musk failed to timely file a beneficial ownership report with the SEC disclosing his acquisition of more than five percent of Twitter’s outstanding shares of common stock in March 2022 in violation of the federal securities laws,” the SEC said in a court filing. Failed.” Sign in.

The SEC withheld that information, saying Musk “was allowed to underpay by at least $150 million for shares he purchased after his financial beneficial ownership report came out.”

Musk’s strength in Trump government

This news comes a week before President-elect Donald Trump returns to the White House for a second term, with Musk among those close to Trump.

Musk is set to play a highly influential role in the new government by leading an advisory body – but not a government agency – that will focus partly on reducing regulations.

Musk, who is the CEO of Tesla and SpaceX, spent more than a quarter billion dollars on groups supporting Trump’s campaign in 2024.

rm/jsi (AFP, Reuters)

Leave a Reply