The head of the SEC preferred to rely on a 90-year-old law to regulate cryptocurrencies.

The lack of regulatory clarity during Gensler’s administration created a legal battleground.

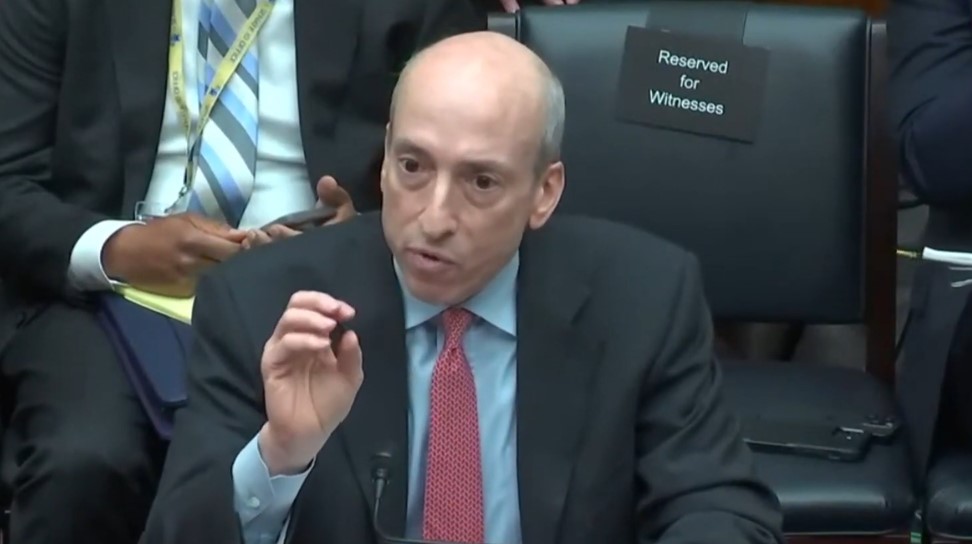

Gary Gensler, chairman of the United States Securities and Exchange Commission (SEC), will leave his position early on January 20, coinciding with the inauguration of Donald Trump as the country’s new president. With his departure, a controversial era for bitcoin (BTC) and cryptocurrencies in general, marked by a restrictive approach taken to regulate the sector, comes to an end.

As soon as he took office in 2021, Gensler said his main goal was to protect investors and mitigate risks in the market. Although initially there was no fear or negative expectations, those first steps turned out to be only the prelude to persecutions and legal procedures.

One of the most controversial points of his management was his expansive approach when interpreting the term “values.” established in the Securities Act of 1933. During its tenure, the SEC labeled a large number of digital assets as securities, forcing many companies in the sector to face costly legal proceedings or, in some cases, withdraw from the market. US.

In an interview published in May of this year, Gensler forcefully stated that, under US law and the interpretation of the Supreme Court, “many tokens are securities.” It should be noted that companies in the sector asked the SEC on multiple occasions, without success, to clarify how the Securities Act of 1933, intended to regulate the issuance and sale of securities, was applied to the digital asset market.

The controversy gained strength mainly due to the lack of regulatory clarity. This is due to divergent opinions on which cryptocurrencies should be considered securities. Despite this, The SEC moved forward with legal actions against several companies in the ecosystem, alleging that they sold unregistered securities.

To date, the SEC considers many crowdfunded tokens, such as an Initial Coin Offering (ICO), to be securities because buyers expect benefits from the efforts of the team behind the project. The classification of cryptoassets as securities has a significant impact on how they can be traded, sold and regulated. If classified as securities, cryptocurrency exchanges would need to register as stock exchanges, which could impact the accessibility and efficiency of digital asset markets.

For all these reasons Gensler was quickly perceived as hostile towards cryptocurrencies.

Lawsuits against companies in the industry

In 2023, the SEC filed a series of lawsuits against major cryptocurrency companies such as Coinbase, Kraken, and Binance. These actions not only created an environment of legal uncertainty, but also discouraged the entry of new players into the market. Following the collapse of FTX in 2022, the reputational damage to the industry was considerable. In an attempt to address what many agencies perceived as abuses and scams, more than 200 coercive measures were carried out.

However, the SEC also initiated legal proceedings against organizations with a lower media profile, such as Impact Theory, accused of offering and selling non-fungible tokens (NFTs) considered unregistered securities, raising approximately $30 million from hundreds of investors. In addition, the agency charged against the company Quantstamp for being an (ICO) and sued the influencer Richard Schueler, known as Richard Heart, for marketing unregistered securities, including the Hex token.

In 2024 the demands did not stop. The SEC filed a complaint against Chicago-based Cumberland DRW LLC, accusing it of operating as an unregistered distributor of crypto assets worth more than $2 billion, which were offered and sold as securities. The complaint stated that the company had been operating in this manner since March 2018.

At the end of last year, the situation was alarming. In November, 18 Republican attorneys general filed a complaint against the SEC, accusing it of exceeding its authority in regulating the cryptocurrency industry. The plaintiffs, from states such as Kentucky, Texas and Florida, argued that the agency had violated the rights of states to regulate their economies, interfering with their sovereignty by aggressively enforcing the law in a sector valued at $3 trillion.

Despite this, there were victories for the industry. Without going too far, last June Consensys reported that the SEC had closed its investigation into Ethereum, confirming that Ether is not a security, but a commodity.

The case of Ripple is emblematic as it has been a legal battle that has spanned over 4 years. In 2023 a judge ruled that Ripple’s sales of XRP to institutional investors constituted unregistered securities offerings, but that programmatic sales (on exchanges) and other uses of XRP were not securities. This was considered a partial victory for Ripple as it implied that XRP was not a security in all contexts.

In October 2024, the SEC filed a notice of appeal against the ruling, seeking review in the Second Circuit Court of Appeals. The appeal does not challenge XRP’s non-security status in programmatic sales, but instead focuses on other aspects of the court ruling, keeping the case without finalizing a final closure.

Criticism and brakes on innovation

The SEC’s restrictive approach caused numerous startups and cryptoasset developers to seek refuge in countries with more flexible regulatory frameworks, such as Dubai or Singapore. This negatively impacted investment and employment within the industry..

Gensler was very vocal and did not miss an opportunity to criticize to the cryptocurrency sector, but, despite its speech focused on consumer protection, it never managed to present a clear and coherent regulatory framework. Although he assured that his approach sought to safeguard investors, Their decisions lacked transparency and created uncertainty about how to actually comply with the rules.. Despite having the necessary tools to leave a positive mark, Gensler chose to follow the path set by the system and government criticism of bitcoin. He did not promote a regulatory framework that responded to current times, but preferred to resort to the Securities Act – a scheme created during the Great Depression – to regulate cryptoassets.

There were those who warned that this approach would not lead to positive results, but the head of the SEC was adamant. In testimony before the Senate Banking Committee in 2023, Gensler dismissed objections and defended his decades of experience in the financial sector, saying he had never seen a market so rife with abuse. He insisted that the SEC needed to act as a “vigilant policeman” and maintain constant regulatory pressure on cryptocurrencies, underscoring the importance of current regulatory tools to combat fraud within the ecosystem.

It is worth mentioning that Commissioner Hester Peirce, who in recent years has built a reputation as a defender of cryptocurrencies, was one of the officials who had the most disagreements with Mr. Gensler. Peirce, a Republican, believes that the government should limit its intervention in the economy, while Gensler, with a career linked to Democratic circles, has adopted more changing positions on various issues. In fact, Jay Clayton’s successor was not always so aligned with his current approach to crypto assets; Before being president of the SEC, The Democrat spent several years at the Massachusetts Institute of Technology (MIT)where he taught courses on digital assets.

In April 2024, Peirce critical The SEC’s guidelines on crypto assets are harshly criticized, particularly Accounting Bulletin 121 (SAB 121), which prevents many banks from holding digital currencies on behalf of their clients. Peirce considered that these regulations do not protect investors and, instead, drive banks out of business. SAB 121 would be repealed by Trump.

The truth is that Gensler received criticism from all sectorsso much so that seven US states formed a coalition to challenge the SEC’s regulation of the industry, led by Iowa Attorney General Brenna Bird. These states argued that the agency was abusing its power and circumventing state laws to impose regulations without proper authorization from Congress.

A new direction

The early departure of Gary Gensler opens the possibility of a change in leadership at the SEC, and many in the bitcoin community hope the next leadership will take a more balanced stance. The hope is that it will encourage innovation and provide regulatory clarity without stifling growth in the sector. In this context, President-elect Donald Trump has nominated Paul Atkins, a strong defender of digital assets, as the future leader of the organization. However, the designation must still be approved by Congress.

As for the outgoing administration of the SEC, well she leaves without an iota of self-criticism. Proof of this lies in the fact that just a few days ago Gensler took advantage of an interview for Bloomberg Television, and stressed that he only wanted to protect investors in an industry that he considers very similar to the Wild West. The economist claimed to have implemented around 100 measures related to cryptocurrencies, which were added to the 80 adopted by his predecessor, Jay Clayton. Furthermore, he once again expressed that, in all his years dedicated to finance, he had never seen a sector so plagued by irregularities.

What Gensler of course did not address are issues such as the SEC taking over a sector that should be under CFTC regulation. One example lies in a lawsuit filed in March 2024, when the U.S. Commodity Futures Trading Commission (CFTC) legally accused the KuCoin exchange of operating a commodity trading platform without proper registration. This action highlighted the lack of regulatory clarity in the country, with the CFTC and SEC applying conflicting criteria to classify cryptocurrencies.

Leave a Reply