Nifty trade setup: The Nifty closing on January 23 with a limit of 0.2 per cent in a limited range. But since last week, it is still roughly roaming within a radius of 23,000-23,400. The overall spirit is of recession with the continuing of lower top and lower bottom on the daily chart. The Nifty is trading below all the important moving averages. In such a situation, this consolidation, which is seen in the market, can continue until the Nifty will give a strong closing above 23,400 with support on 23,000. Market experts say that due to the breakdown of this support, the Nifty can go down to the level of 22,800.

Here you are giving some such figures on the basis of which you will be able to catch profitable deals.

Support and Resistance Level (Important Level 23,205) for NIFTY

Related news

Support based on Pivot Point: 23,120, 23,078 and 23,009

Resistance based on Pivot Point: 23,258, 23,300 and 23,369

Bank Nifty (Important Level 48,589)

Resistance based on pivot points: 48,811, 48,905, and 49,058

Support based on pivot points: 48,506, 48,411, and 48,259

Resistance based on Fibonacci Retress: 49,453, 50,406

Fibonacci Retress based support: 47,878, 46,078

Nifty call option date

A maximum call of 90.58 lakh contracts has been seen open interest on a strike of 24,000 on a weekly basis, which will work as an important registration level in the upcoming business sessions.

Nifty put option data

A maximum of 67.96 lakh contracts have been seen open interest on a strike of 23,000, which will work as important support level in the coming business sessions.

Bank Nifty Call Option Data

The bank Nifty has seen a maximum call open interest of 25.88 lakh contracts on a strike of 49,500, which will work as an important registration level in the upcoming business sessions.

Bank Nifty put option data

On a strike of 47,500, a maximum put of 17.54 lakh contracts has been seen open interest, which will work as important registration levels in the coming business sessions.

FII and DII Fund Flow

Voltyness Index, India Vix was softened yesterday. It fell 0.46 percent to 16.70. But it is made in the Higher Zone which is a sign of caution for the stunnings.

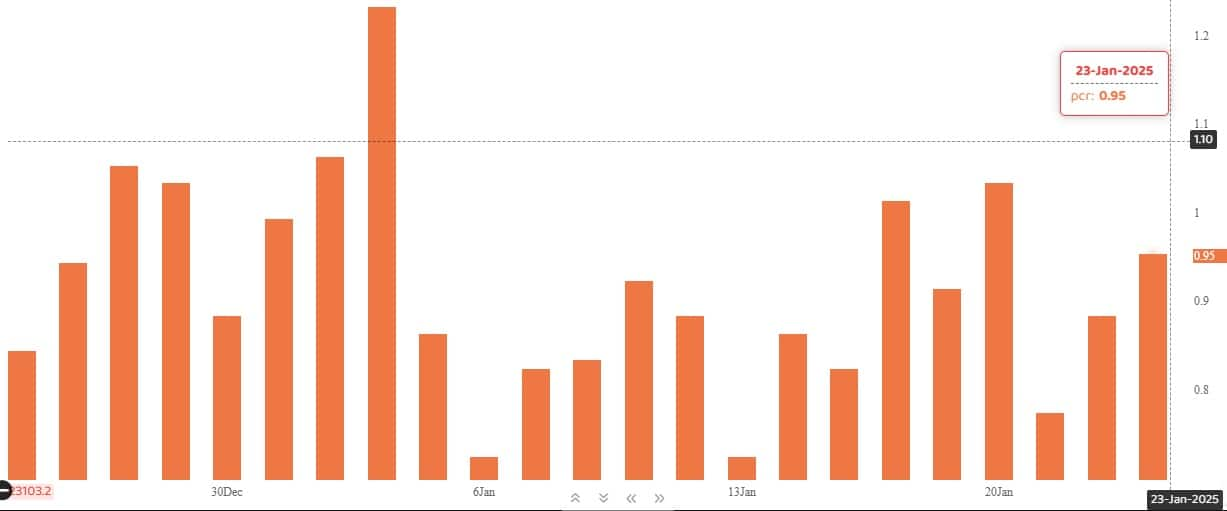

Call call ratio

The Nifty put-kal ratio that reflects the market mood rose to 0.95 on January 23, compared to 0.88 in the previous session. Significantly, the departure of PCR above 0.7 or 1 cross PCR is generally considered a sign of boom. Whereas the ratio falling below 0.7 or 0.5 is a sign of recession.

Stock Market Live Updates: Gift Nifty Indication, Indian market can be strong

Stock under F&O Bain

The F&O segment includes the restricted securities that include the derivative contract market wide position limit to more than 95 per cent.

Stocks involved in F&O ban: nobody

Stocks already involved in F&O ban: Aditya Birla Fashion & Retail, Bandhan Bank, Can Fin Holmes, Dixen Technologies, Indiamart Ermesh, L&T Finance, Manappuram Finance, Metropolitan Gas, Punjab National Bank

Stocks removed from F&O ban: Rbl bank

Disclaimer: The ideas given on Moneycontrol.com have their own personal views. The website or management is not responsible for this. Money control advises users to seek the advice of certified experts before taking any investment decision.

Leave a Reply