Income Tax Slabs 2025: Finance Minister Nirmala Sitharaman gave a big relief to the middle class and increased the income tax exemption limit from Rs 7 lakh to Rs 12 lakh in the new tax regime. If you add standard deductions of Rs 75,000 to it, then after this change, people with income up to Rs. 12.75 lakhs annually will not have to pay any tax. The Finance Minister also announced a new income tax slab in Budget 2025. This new tax slab will be applicable to those who earn more than Rs 12.75 annually.

It is necessary to state here that the Finance Minister has increased the tax exemption limit, not the original exemption. The government has announced a tax exemption of up to Rs 80,000 to tax holders in the budget. Since the annual income of up to Rs 12 lakh, a tax liability of Rs 80,000 is coming. In such a situation, they will not have to pay any tax due to tax rebate (exemption). But if your income is more than this, then you will have to pay tax according to the new tax slab on the entire income.

Neetu Brahma, director of Nangia Anderson India, said, “The government has given a tax rebate, not tax examping. This means that if the total tax of the person is limited to Rs 12 lakh, then its tax due to the tax rebate It gets more than 12 lakh rupees if taxable total income is more than 12 lakh rupees.

Related news

According to the new changes, there will be no tax on the income of up to Rs 4 lakh for those who have annual income more than Rs 12 lakh. At the same time, 5 percent will be taxed on income between Rs 4 to 8 lakh, 10 percent on 8-12 lakh rupees, 12-16 lakh rupees at the rate of 15 percent. While 20 percent on income between Rs 16 to 20 lakhs, 25 percent on 20-24 lakh rupees and 30 percent income tax on income of more than Rs 24 lakh will be incurred.

At the same time, the zero tax limit on income up to Rs 12 lakh will be applicable only to those people whose income is not more than this limit.

The new tax slab announced by Finance Minister Nirmala Sitharaman for the new tax regime in Budget 2025 is given below.

Up to ₹ 4 lakh – No tax

₹ 4 to 8 lakhs – 5%

₹ 8 to 12 lakhs – 10%

₹ 12 to 16 Lakh – 15%

₹ 16 to 20 lakhs – 20%

₹ 20 to 24 lakhs – 25%

Over ₹ 24 lakh – 30%

How much will be tax savings?

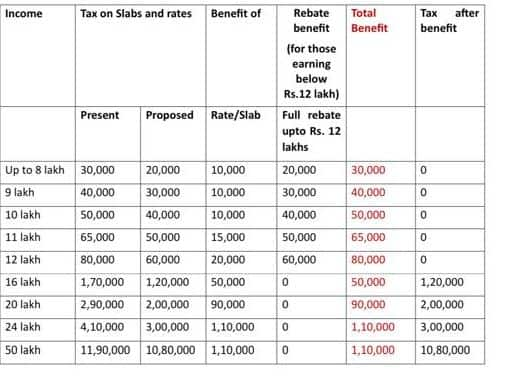

The new tax slab will now save more than before and will save more money to spend in his pocket. For example, from the new slab –

– Annual income of up to ₹ 12 lakhs The person will have a tax savings of ₹ 80,000.

– ₹ 18 lakh annual income A person will have a tax savings of ₹ 70,000.

– Over 25 lakh annual income Those will save ₹ 1.1 lakh (25%of the total tax payable).

The Finance Minister said in his speech that the government would suffer a loss of Rs 1 lakh crore in direct taxes and Rs 2,600 crore in indirect taxes due to changes in these new tax slabs and rates.

Tax slab imposed under the new tax regime (this tax slab will be closed from next assessment year)

Up to ₹ 3 lakh – no tax

From ₹ 3 lakh to ₹ 7 lakh – 5%

From ₹ 7 lakh to ₹ 10 lakh – 10%

₹ 10 lakh to ₹ 12 lakh – 15%

₹ 12 lakh to ₹ 15 lakh – 20%

Over ₹ 15 lakh – 30%

Please tell that Finance Minister Nirmala Sitharaman has not announced any change in the old tax regime.

Also read- Budget 2025: Mobile, LED TV, medicines will be cheap, know what happened cheap and expensive in the budget

I got what you intend,saved to bookmarks, very decent website .