Stock market outlook: Last week, the Indian stock market took a 1 percent lead, which came after two consecutive weeks weakness. The major reason for this has been a shocking decision of RBI, in which the repo rate cut 50 basis points (BPS). Market was expected to cut 25 BPS.

Now the market is likely to remain a positive attitude in the week starting on Monday i.e. 9 June. Research head Siddharth Khemka in Motilal Oswal Financial Services believes that the Indian markets will now see a slow, but stable boom, especially due to RBI’s higher rate deduction and discussions of the Indo-US trade agreement.

Khemka said that in addition to the interest rate areas, monsoon-based areas such as fertilizer, agro-chemical, rural finance and two-wheelers will also be in focus, as 2025 predicts better monsoon than normal in 2025. However, he also warned that there may be any unusual change in the US tariff policy and britian stress volatility.

Let’s know about those 10 major factor, which will decide the direction and condition of the market next week.

Cpi inflation rate

Investors will keep an eye on inflation data on the consumer price index (CPI) inflation to be released on June 12. This is an important figure for RBI’s interest rate decision. Most economists are considering inflation rate below the target of 4 percent for the year 2025.

In addition, the trade balance data for the month of May and Forex reserves for the week ended on 6 June will also be released on 13 June.

US inflation rate

Globally, investors’ eyes will be on the US inflation rate to be released on June 11. According to global economists, inflation and core inflation in May may increase slightly against the previous month’s 2.3 percent and 2.8 percent of the previous month, which can be due to tariff rates.

Apart from this, the producing price index (PPI) and weekly employment data of May will also be important.

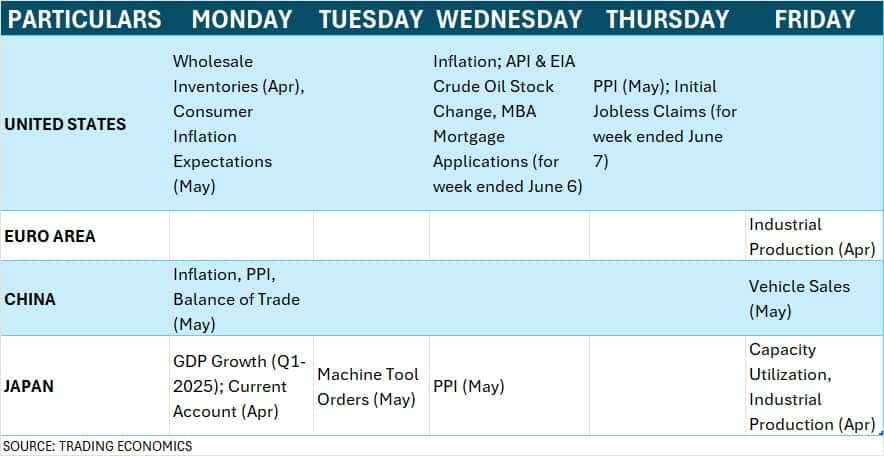

Global Economic Data

China’s inflation, PPI and vehicle sales figures will also be released in the next week. Japan will announce GDP figures and PPI for the January-March quarter.

Indo-American Trade Agreement

Apart from economic data, investors will also keep an eye on progress in Indo-US trade talks. Negotiations are going on between the two countries to reduce tariffs and neck-tariff barriers and promote supply chains.

Reuters quoted government sources as saying that negotiations have been extended by next week to make an agreement on tariff cuts in agriculture and auto sectors to finalize an interim agreement before 9 July.

Foreign investors’ trend

The market will also keep an eye on the mood of foreign institutional investors (FIIs) as they sold a net selling of Rs 3,566 crore last week. This was the third consecutive week of clearance. However, tremendous purchases were observed in May. At the same time, domestic institutional investors (DII) have made a net purchase of shares worth Rs 25,513 crore and continued investing continuously since August 2023, compensating for FII selling.

The US dollar index fell 0.24 percent to close at 99.202 during the week, which remained below all major moving averages. At the same time, the US 10-year-old treasury yield increased by 2.5 percent to 4.508 percent.

IPO market condition

Four IPOs open next week in the primary market, one of which is from the Mainboard segment. The IPO of Oswal Pumps will come on Dalal Street on 13 June. At the same time, Sacheerome’s IPO from SME segment will open on June 9, Jainik Power and Cables IPO 10 June, and Monolithisch India’s IPO will open for subscription on June 12.

Apart from this, the listing of Ganga Bath fittings will be held on 11 June at NSE Emerge.

Technical view

Technically, the market situation is now looking better after selling for the last two weeks. With a strong faster Friday, Nifty 50 traded above all major moving averages (10, 20, 50 and 200-week EMA), with a positive crossover in MACD and RSI with good volumes.

Bollinger bands are spread on both sides, and the upper line is showing a target of 25,300. Overall, a level of 25,000 is considered an important zone for the index. Staying on top of it can open the way for 25,200 and 25,500 levels. At the same time, strong support is being considered on 24,800 and 24,500. According to experts, the index is close to a downtrend resistance line breakout and cannot be denied strong rapidly.

According to a weekly options data, the level of 25,000 will be important to decide the direction of NIFTY 50. At the same time, there is resistance at 25,500 and support on 24,800-24,700.

The maximum call Open Interest is at a strike price of 26,000, followed by a strike of 25,500 and 25,000. Call writing is the highest on a strike of 25,500, followed by 25,600 and 26,000. The put side has a maximum open interest at 25,000, followed by 24,700 and 24,800, while maximum put writing is recorded at 25,000, then 24,900 and 24,600 on strikes.

India Vix measures the volatility of the stock market. It remained in the second consecutive week decline and closed below 15, which further strengthened the bulls in the market. If it remains below 15, there can be more relief. It fell 9 percent a week to close at 14.63 and all went below the major moving average.

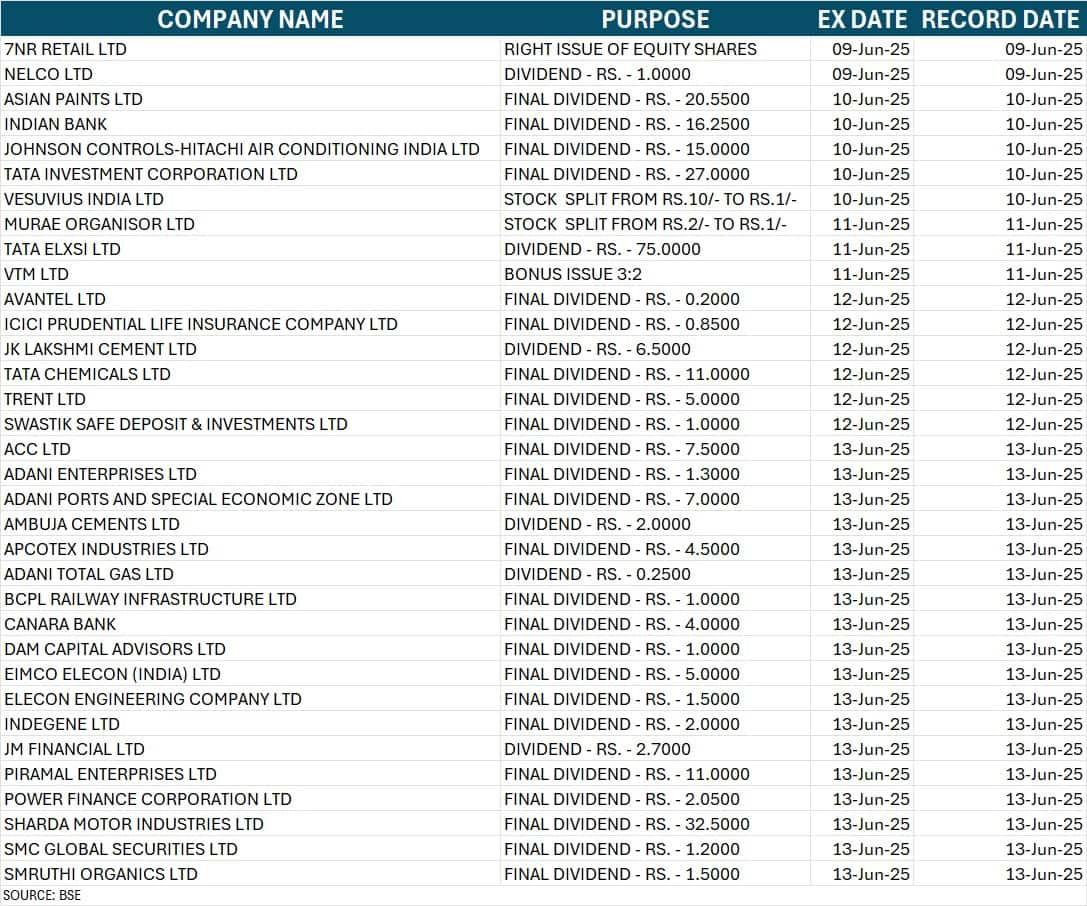

Next week, many companies will also show many corporate action like dividend and stock split. (See chart)

Also read: HDFC Bank vs Lilavati: Mehta Family FIR against HDFC Bank’s CEO, know what is the whole matter

Disclaimer: The ideas and investment advice given by experts/brokerage firms on Moneycontrol are their own, not the website and its management. Moneycontrol advises users to consult a certified expert before making any investment decision.