The growing conflict between Israel and Iran, with firing missiles and drones on each other, has ignored the global energy markets.

The Israeli attacks on Saturday targeted Iran’s energy infrastructure, including significant oil storage sites, refiners and power stations.

The targeted places had a large -scale South Parse gas area, part of the world’s largest reservoir of natural gas. It is located away from the southern Bushar province of Iran and is the source of most gases produced in Iran.

Iran shared control over the South Pars gas area with the neighbor Qatar, which describes the reservoir under its control North Dome.

The attack, which forced Tehran to partial suspended production in the region, promoted the possibility that a winning conflict would threaten Iran’s energy production and supply.

External Affairs Minister Abbas Araghchi has slammed Israel to target the South Pars, saying what attempts have been made on Iran’s attempt to expand.

The news agency AFP said with foreign diplomats, “Drawing the struggle in the Persian Gulf region is a major strategic mistake, possibly intentional and intended to expand the war beyond the Iranian region.”

Iran’s heavy dependence on hydrocarbons

According to the US Energy Information Administration (EIA), Iran is a prominent player in the Global Energy Sector, with the country’s home for the second largest proven natural gas reserve in the world.

Data from inter -government gas exporting countriesShow that Iran produced about 266.25 billion cubic meters (BCM) in 2023, with domestic consumer accounting for 255.5 BCM. About 15.8 BC of natural gas was exported.

Iran holds the third largest crude oil reserve in the world, which is about 9% of the total proven oil reserve worldwide.

According to the country Belgian -based data firm KPLER, about 3.3 million barrels extract raw raw and other 1.3 million barrels and other liquids, which exports about 1.8 million barrels.

Iran is the third largest oil producer in Petroleum Exporting Countries (OPEC) organization. The income generated from energy exports is for a large part of government revenue and foreign exchange reserve.

An EIA report shows that Iran received $ 144 billion (€ 138.5 billion) Oil export revenue in three years from 2021 to 2023.

According to the report, “Iran searches for closing the signals of its ship, implementing its ship’s identity signs, implementing transfer, or cargo from both countries as cargo arising from other countries, which increases the challenge of providing pre-infidel data.”

Reuters of the news agency reported that China remains a major importer of Iranian crude, which imports 1.71 million BPD in March, 20% from 1.43 million BPD in February.

The price of crude oil increased at the end of last week after the Israeli-Iran attacks started, but it has decreased, with both the main oil contracts to fall by more than 1% on Monday.

Should Israel accelerate its targeting of Iranian energy features, however, it can trigger spikes in global oil and gas prices.

Restricted Iran’s economy

Despite Iran’s huge hydrocarbon reserve, most of its capacity remains without stopping.

Iranian officials admitted that the country needs advanced technology and billions of dollars in new investment to modernize its oil and gas sectors.

But the country is subject to one of the most stringent approval regimes in the world, obstructing its trade and investment opportunities.

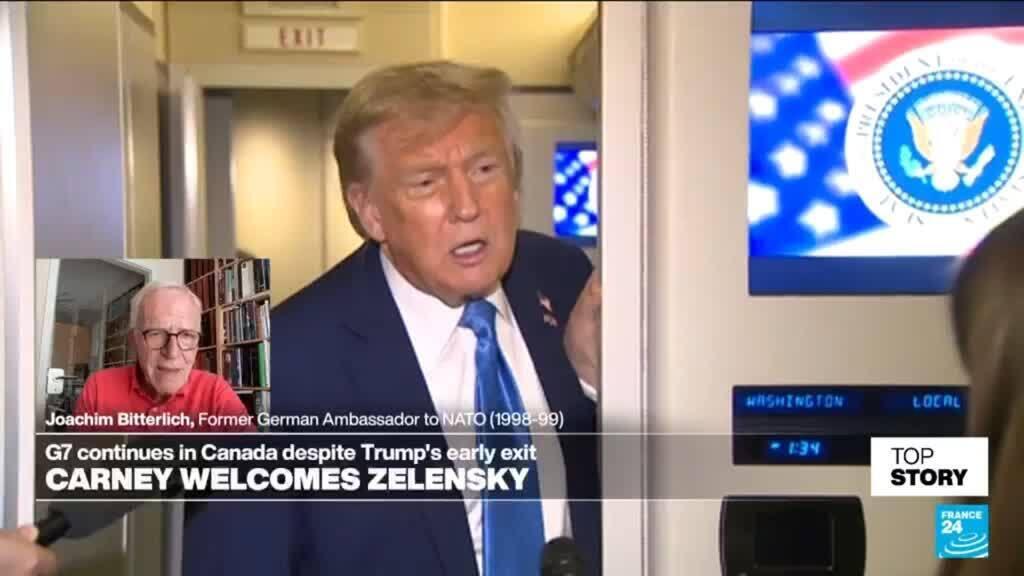

Although in 2015, a historic nuclear deal between Iran and world powers promised restrictions in exchange for restricting the country’s nuclear activities, President Donald Trump withdrew the United States unilaterally from the agreement in 2018 and resumed restrictions during his tenure in the office.

The restrictions aimed at curbing Tehran’s atomic and ballistic missile programs have targeted banking and shipping between Iran oil exports, as well as other areas.

He has very severely mentioned Tehran’s natural gas exports in recent years.

Measures have effectively cripped Iran’s economy, which is currently from a fleet of discovery of inflation and crisis as a collapsing currency.

Blackout in an energy-rich country

Decades of mismanagement and geopolitical stress have reduced economic problems. Despite its huge oil and gas resources, Iran is struggling with lack of energy amid declining production, old equipment and lack of infrastructure.

Iran depends a lot on natural gas for domestic consumption, especially for power generation. Additionally, more than 95% of Iranian homes are connected to gas pipelines, and energy subsidies have resulted in overconconsompat.

In recent years, Iran’s government has been forced to implement rolling power blackout affecting both homes and factories to face spikes in demand for electricity.

In May, President Masaud Peseshkian criticized what he called for Iran’s “excessive and inappropriate consumption of electricity”.

Edited by: Uwe Hessler