The Strait of Hormuz is a major waterway that lies that the Gulf of Oman and Iran, and the Gulf of Persia connects the Gulf of Oman and Arabian Sea.

US Energy Information Administration (EIA) Describe it as the “world’s most important oil transit chokpoint”.

At its narrow point, the waterway is just 33 kilometers (21 mi) wide, just two miles wide in the ether direction with shipping lane, making it crowded and dangerous.

OPEC countries such as Saudi Arabia, United Arab Emirates, Kuwait and Iraq consumed the flow globally through the raw volumes extracted by the raw countries from the oil areas in the Gulf region of the Persia.

About 20 million barrels of raw, condensate and fuel are estimated to be flowed through daily waterways, according to Vortex data, energy and goods for market consultants.

Qatar, one of the world’s largest producers of liquefied natural gas (LNG), depends a lot on the straight to ship its LNG exports.

What is the current situation in Strait?

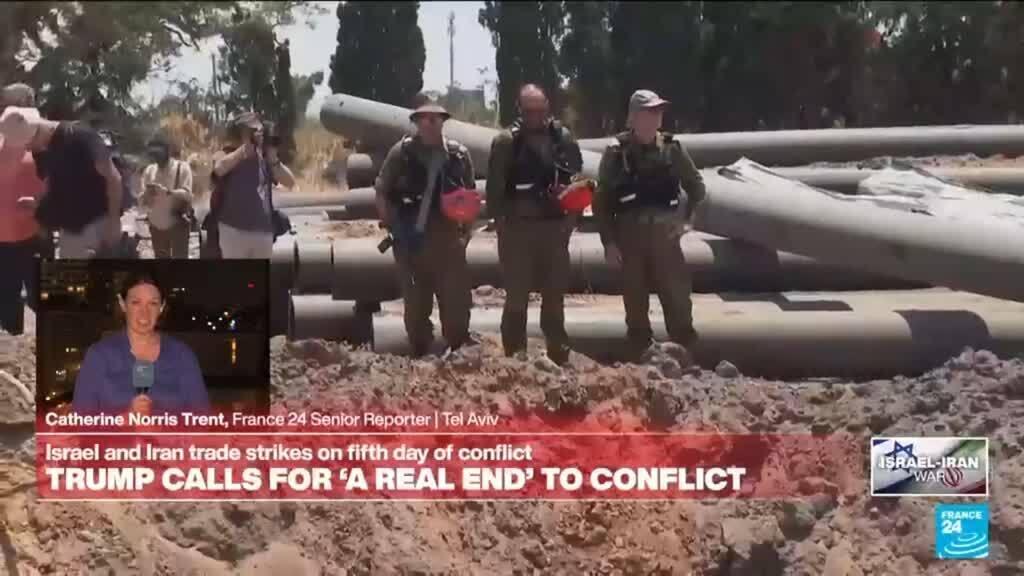

The conflict between Israel and Iran has focused a focus on security in the waterway.

Iran has threatened to shut down the strainer of Hormuz for traffic in vengeance under Western pressure in the past.

Since there was a fight between Israel and Iran, however, there has been no major attack on commercial shipping in the region.

The AP news agency reported that the shippanders are beware of using the waterways, some ships have tight security and cancellation of others, the AP News Agency said.

Navy sources told Reuters News Agency that electronic intervention with commercial ship navigation systems has increased around the waterway in recent times and against the Gulf. This intervention is affecting the ships of sailing through the area, he said.

As there seems to be no immediate end of conflict, the market lives on the shore. Any blockade of interruption of waterways or oil flows can trigger a sharp spike in raw prices and energy can give a tough competition to importers, especially in Asia.

The rate of tanker for ships carrying raw and sophisticated oil products from the region has jumped in recent times.

Citing the Baltic Exchange data, the cost of fuel from the Middle East to East Asia rose to about 20% in three sessions in three seasons on Monday. Meanwhile, East Africa’s rates jumped over 40%.

Who wants to influence in case of supply disruption?

The EIIA estimates that 82% of the raw and other fuel shipments crossing the Strait went to Asian consumers.

China, India, Japan and South Korea thesis were the top sites with four countries, all about 70% of crude oil and simultaneous accounting for condenset flows, which detected the Strait.

Thesis markets will probably be affected by disruption in supply in straight.

How does a closed Iran and Gulf states affect the states?

If Iran takes action to close the Strait, it can potentially draw military intervention from the United States.

The American fifth fleet located in a nearby Bahrain has been tasked to protect commercial shipping in the region.

Any step to disrupt the flow of oil through waterways by Iran may endanger Tehran’s relations with Gulf Arab states in recent years with the countries of Saudi Arabia and the United Arab Emirates – countries with Iran.

Gulf Arab countries have so far criticized Israel for starting an attack against Iran, but if their oil exports are interrupted in Tehran’s works, they can be pressurized against Iran.

In addition, Tehran depends on the strainer of the hormuz to ship his oil to his customers, Experts say this is the opposite to shut down the straight.

Reuters said, “Iran’s economy depends a lot on the free route of goods and ships through sew, as its oil exports are completely sea -based,” Reuters quoted JP Morgan as saying Natasha Kanwa, Pretake Kedia and Luba Savinova. “Hormuz will be defeated by cutting the strainer of the hormuz for its only oil customer, Iran’s relations with China.”

What are straight options?

Gulf Arabs like Saudi Arabia and UAE have alternative routes to bypass Strait in recent years.

Both countries have established infrastructure which allows the subject to transport some of its crude through other routes.

For example, Saudi Arabia operates the east-west crude oil pipeline with a capacity of five million barrels per day, while the UAE has a pipeline connecting its onshore oil areas to the Oman’s Gulf of Oman with a Fuzarah export terminal.

The EIA estimates that about 2.6 million barrels of barrels per day may be available to bypass the hormuz’s drainage in the event of waterways disruptions.

Edited by: Tim crook