Market Trade Setup: The Nifty remained within a tight scope of 24,700-25,000 for the third consecutive day and closed down a slight decline of 41 points on 18 June. Consolidation continued in the market yesterday. Traders maintained vigilance before the Federal Reserve decision. The US Fed has retained the interest rate at 4.25-4.50 per cent in its decision last night. The Nifty fell below the mid-line of 20-Day EMA and Bollinger band. This is a sign of weakness. However, the Volatibility Index India has become more favorable for Vix Bulls. Market experts say that the consolidation can continue until the Nifty breaks the range of 24,700-25,000. Support is supported at 24,500 for Nifty. At the same time, on going up from 25,000 on the top, 25,200 will have the next major resistance.

Here you are giving some such figures on the basis of which you will be able to catch profitable deals.

Support and resistance level for nifty

Support based on Pivot Point: 24,761, 24,715, and 24,640

Resistance based on Pivot Point: 24,912, 24,959, and 25,034

Bank nifty

Resistance based on pivot points: 55,919, 56,019 and 56,180

Support based on pivot points: 55,597, 55,497, and 55,336

Resistance based on Fibonacci Retress: 56,099, 56,810

Fibonacci Retress based support: 55,266, 54,845

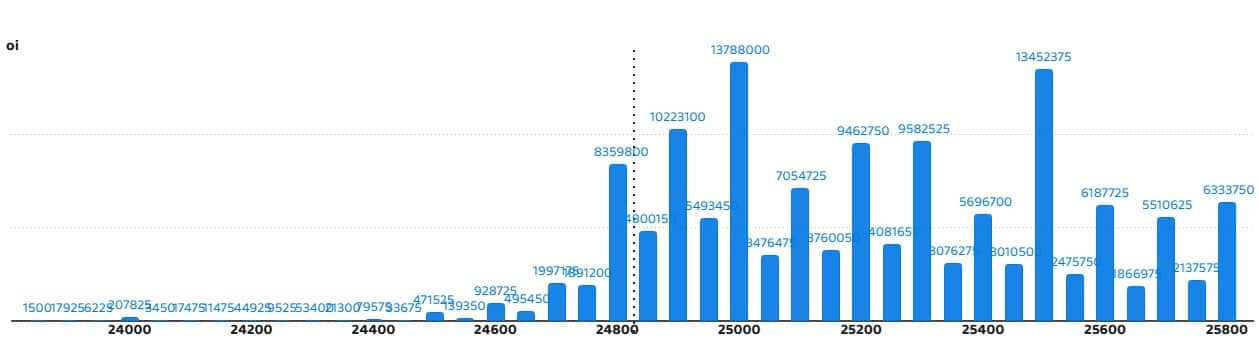

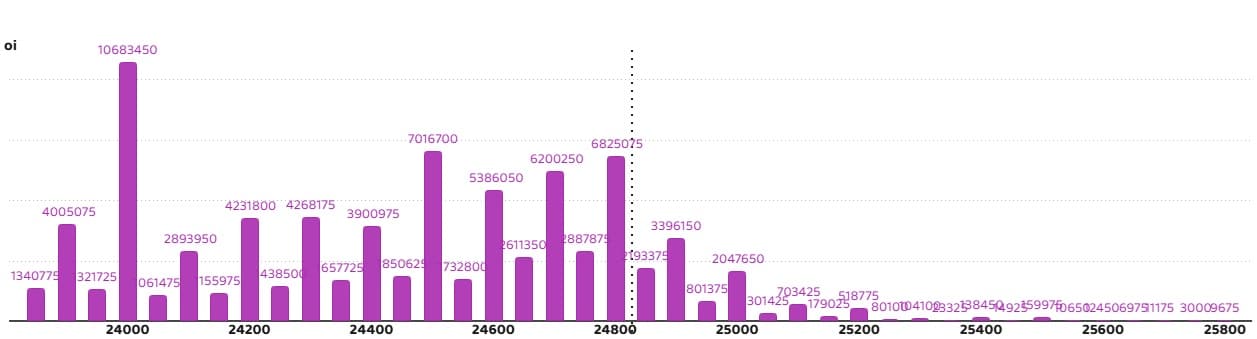

Nifty call option data

A maximum call of 1.37 crore contracts has been seen open interest on a strike of 25,000 on the monthly basis, which will work as an important registration level in the upcoming business sessions.

Nifty put option data

On a strike of 24,000, a maximum of 1.06 crore contract has been seen open interest, which will work as important support level in the coming business sessions.

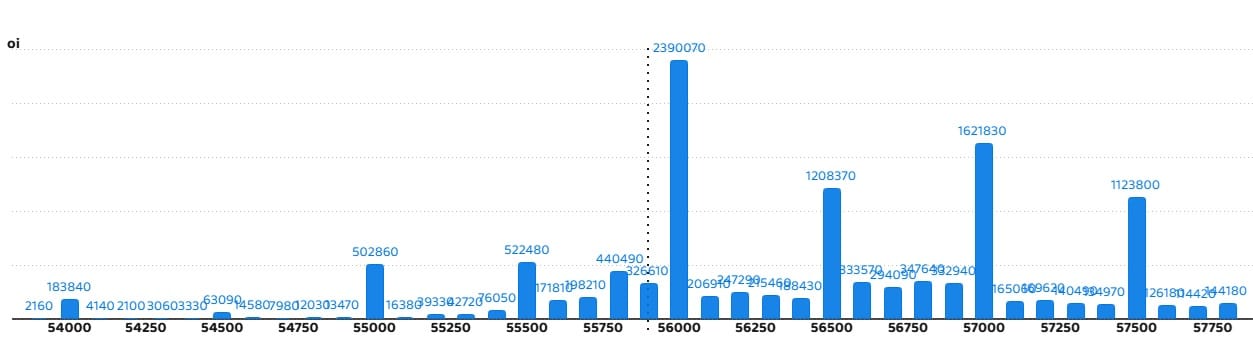

Bank Nifty Call Option Data

Bank Nifty has seen a maximum call open interest of 23.9 lakh contracts on a 56,000 strike, which will work as an important registration level in the upcoming business sessions.

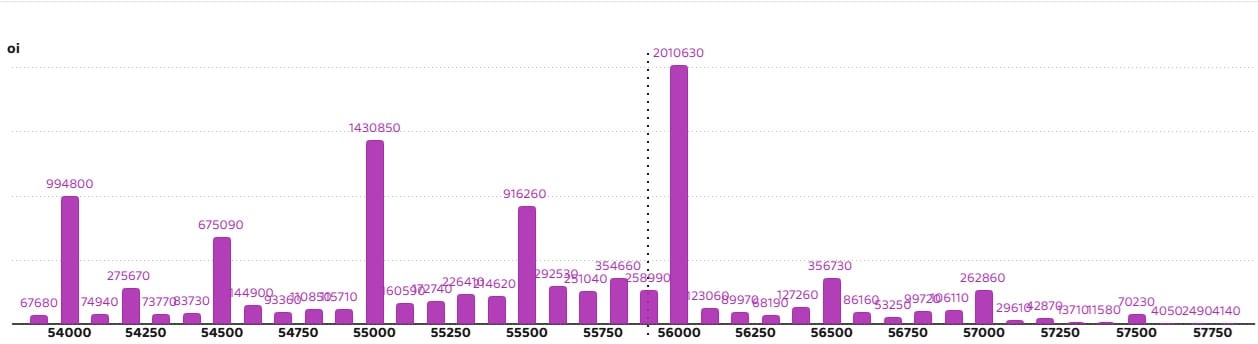

Bank Nifty put option data

A maximum of 20.1 lakh contracts have been seen open interest on a strike of 56,000, which will work as important registration levels in the coming business sessions.

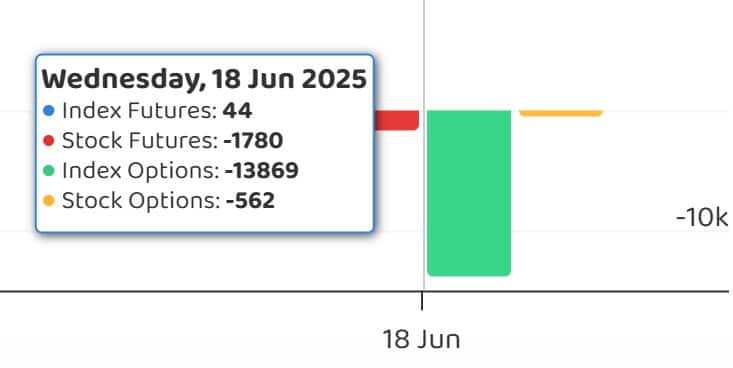

FII and DII Fund Flow

India’s possible viage measuring index below the level of VIX 15. It closed down 0.89 per cent to close at 14.28. It remains favorable for bulls until it remains below all the important moving averages.

High delivery trade

Here are the stocks given in which the largest part of the delivery trade was seen. The large part of delivery reflects the interest of investors (unlike trading) in stock.

Stock Market Live Update: Gift Nifty indication, weakened Indian market move

Long build-up shown in 45 stocks

Along with the increase in open interest, the rise in prices is also usually estimated to become a long position. Long build-ups were seen in 45 shares on the last trading day based on Open Interest Future Percentage.

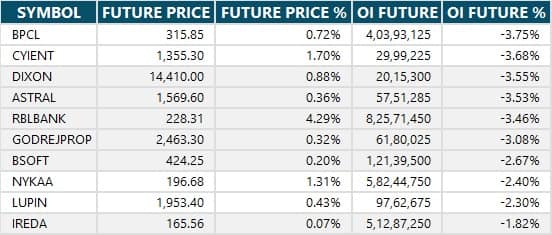

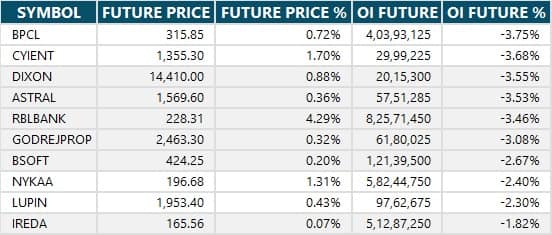

Long Unwinding seen in 41 Stocks

Along with the fall in open interest, the fall in prices is also usually gauged by long disagreement. Based on the Open Interest Future Percentage, the highest long long long long -term unwinding was seen in 19 shares on the previous trading day.

Short build-up shown in 107 stocks

Along with the increase in open interest, the decline in prices is also usually gauged by short build-up. Based on the Open Interest Future Percentage, the highest short build-up was seen in 107 shares on the previous trading day.

Short covering seen in 31 stocks

Short covering is usually estimated by the rise in open interest as well as the rise in prices. Based on the Open Interest Future Percentage, 31 shares saw the highest short cover in 31 shares.

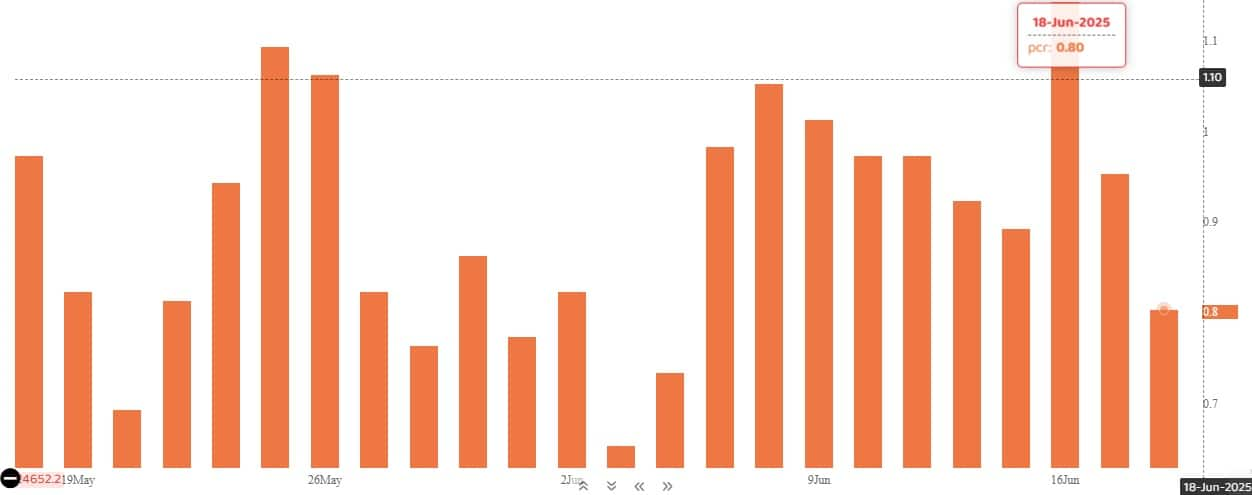

Call call ratio

The Nifty Put-Call Ratio (PCR), which depicted the market mood, declined to 0.80 on June 18, compared to 0.95 in the previous season. Significantly, the departure of PCR above 0.7 or 1 cross PCR is generally considered a sign of boom. Whereas the ratio falling below 0.7 or 0.5 is a sign of recession.

Stock under F&O Bain

The F&O segment includes the restricted securities that include the derivative contract market wide position limit to more than 95 per cent.

Stock involved in F&O ban: Biocon

Stocks already involved in F&O ban: Aditya Birla Fashion & Retail, Birlasoft, Central Depository Services, Chambal Fertilizers & Chemicals, Hoodco, Manappuram Finance, RBL Bank, Titagadh Rail Systems

Stocks removed from F&O ban: IREDA

Disclaimer: The ideas given on Moneycontrol.com have their own personal views. The website or management is not responsible for this. Money control advises users to seek the advice of certified experts before taking any investment decision.