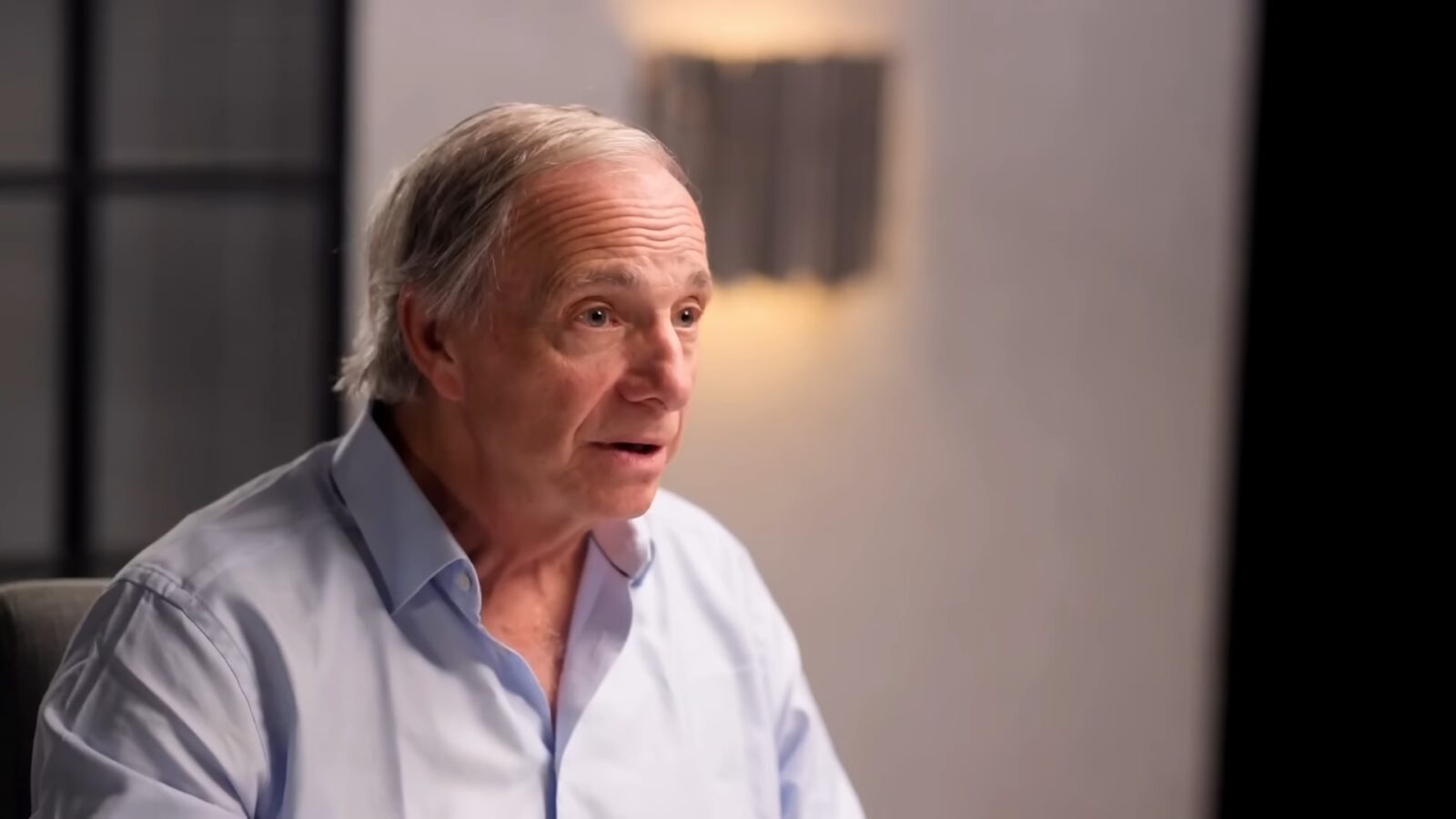

American investor Ray Dalio, founder of Bridgewater Associates, warned that the recent decision by the Federal Reserve (FED) to stop quantitative tightening (QT) and prepare the return of quantitative easing (QE) is an unequivocal sign of the end of the great debt cycle. A process that he has described as the tipping point at which debt and stimulus excesses converge toward a structural correction.

dalio holds that “the FED is stimulating [la economía] towards a bubble”, referring to the turn in monetary policy announced by Jerome Powell, the president of that organization.

“Although it is described as a technical maneuver, in any case it is a flexibility measure,” he points out. The investor considers that this change “is one of the indicators to follow to track the progression of the Great Debt Cycle”, a concept that defines the successive stages of expansion, leverage and inflation that precede economic readjustment.

Dalio cites Powell’s own words, saying that at some point “reserves will want to start growing gradually to keep up with the size of the banking system and the economy.”

For the analyst, the fact that the FED is once again expanding its balance sheet while cutting rates and fiscal deficits remain high “configures a classic interaction between the FED and the Treasury to monetize government debt.”

The founder of Bridgewater emphasizes that this scenario occurs while “private credit and capital market credit remain strong, stocks are at highs, credit spreads are at minimums, unemployment is low, inflation is above target and AI stocks are in a bubble.”

The following table shared by Dalio shows a comparison of different historical episodes of monetary stimulus—the Great Depression, World War II, the 2008 global financial crisis, the first quantitative easing program (QE1) and the COVID-19 pandemic— in contrast to the current conditions of the American economy. Indicators include real GDP growth, unemployment rate, inflation, cyclically adjusted price-earnings ratio (CAPE), credit spreads and public debt to GDP.

The comparison reveals that, unlike previous periods in which stimulus was applied during recessions with high unemployment and low inflation, the current situation combines positive growth, low unemployment, moderate inflation and record stock market valuations, with historically high government debt (118% of GDP).

This suggests, according to Ray Dalio, “that this time monetary easing will occur within a bubble, instead of a crisis.”

Valuation of financial assets is imminent

Dalio details that these types of policies, applied in a context of stock market euphoria, expand the valuations of financial assets, They compress real returns and tend to increase wealth inequality. He also warns that when the supply of Treasury bonds exceeds demand and the central bank “prints money” to absorb them, “classic end-of-debt cycle dynamics” are reached.

“QE now would not be a stimulus in a depression, but a stimulus in a bubble,” emphasizes Dalio. This type of intervention, he adds, “monetizes government debt rather than simply reliquidating the private system,” which “seems like a bold and dangerous bet on growth, especially growth driven by artificial intelligence, financed by extremely lax fiscal, monetary and regulatory policies.”

Dalio’s analysis is consistent with recent market interpretations of the independence of the bitcoin price from global liquidity cycles. As reported by CriptoNoticias, the digital currency has shown a tendency to anticipate monetary policy changes, acting as a leading indicator of credit expansion or contraction. In this context, the possible return of QE and the increase in liquidity could favor a new phase of bitcoin appreciation against the weakening of the dollar and expected inflation.

With the return of monetary expansion and the simultaneous rise of technological and financial assets, Dalio concludes that the global system is approaching a critical point of the Great Debt Cycle, in which the interaction between fiscal and monetary policy is no longer sustainable. “It will be important to observe how much the FED’s balance sheet will expand,” he said, warning that the outcome of this cycle could redefine market conditions for years to come.

Leave a Reply