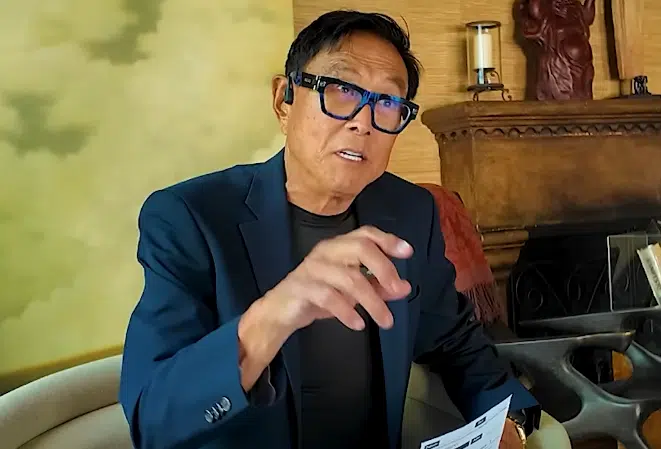

“I follow the laws of money, the laws of Gresham and Metcalf,” says Robert Kiyosaki in the tweet he published on November 9, where he reiterates his practice of buying assets other than fiat money. It also launches new predictions for the price of bitcoin in 2026 (with significant growth).

In his publication, the investor turned on the alarms again about an imminent crash massive. A prediction that he has been making for a long time and on which he bases most of the recommendations he makes to his followers.

To face the crisis, Kiyosaki advises the purchase of “good money”a characteristic that it gives to bitcoin (BTC) and cryptocurrencies such as ether (ETH). Includes precious metals such as gold and silver. “I continue buying even when their prices plummet,” he said, referring to the recent market decline.

With this strategy, the author of “Rich Dad, Poor Dad” claims to follow the rules of money proposed by two well-known English-speaking authors.

One of them (Thomas Gresham) establishes that “bad money”—of lower intrinsic value—ends up displacing “good money.” It happens because people They tend to keep good money as a haven of value, spending bad money. A trend that Kiyosaki supports the importance of buying bitcoin.

Metcalfe’s Law, for its part, states that a network becomes more valuable as more people join it. The rule, created by American Robert Metcalfe, highlights the exponential value that the Bitcoin Network reaches. This, as adoption grows of digital currency globally.

What would be the price of bitcoin and gold in 2026?

Based on these two rules, Kiyosaki claims that by 2026 Satoshi Nakamoto’s creation will be priced at USD 250,000. Gold would reach $27,000 and silver would be around $100. The Ethereum network would grow exponentially in followers. All this following the Metcalfe Law.

Based on these predictions, the investor recommends investing in these assets, since he considers that it is the best way to deal with crash.

However, it is worth remembering that Kiyosaki’s recent history of predictions has been the subject of analysis. As reported by CriptoNoticias, last February he predicted “the most serious fall in the stock market in history.” An event that did not materialize in the proposed terms.

He also said that the price of bitcoin would reach USD 200,000 in 2025. A value that, according to analysis, is not very likely in the short time left of the year.

But, although the accuracy of its deadlines has been questioned, Kiyosaki’s underlying message remains consistent: distrust in the traditional financial system. The failures in traditional monetary policy are also part of the criticism. Something that also stands out in this Sunday’s tweet:

Unfortunately, the US Treasury and Federal Reserve are breaking the law. They print fake money to pay their debts. If you and I did what the Federal Reserve and the Treasury do, we would be in jail for committing crimes.

Robert Kyosaki.

Leave a Reply