For Peter Schiff, people only want bitcoin because they believe its value will continue to rise.

CZ maintains that BTC’s intangibility does not mean it is worthless.

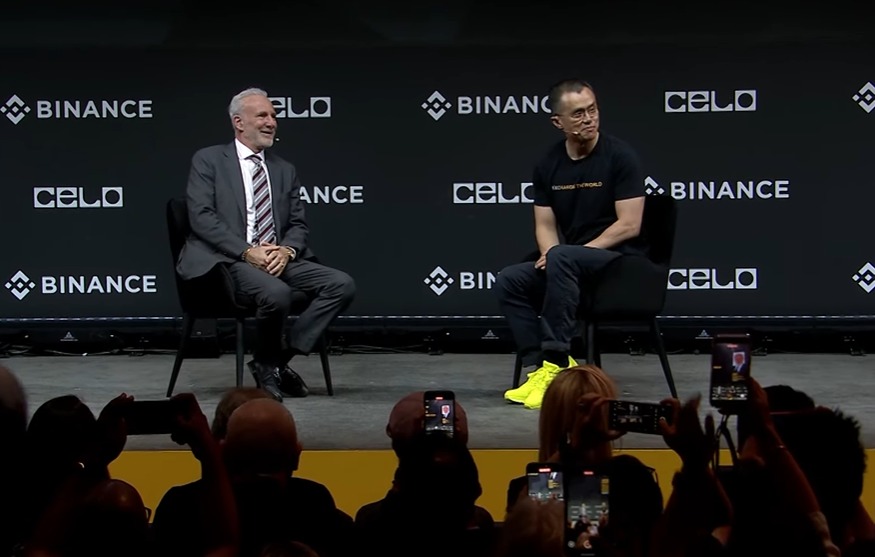

The recent debate between millionaire stockbroker Peter Schiff and Changpeng Zhao (CZ), co-founder and former CEO of cryptocurrency exchange Binance, held the audience captive for almost an hour as they discussed the value of bitcoin (BTC) against gold.

The meeting, which took place at the Binance Blockchain Week event in Dubai on Thursday, December 4, 2025, began with a cordial but direct tone. As host, CZ thanked Schiff, a renowned maximalist gold economist and bitcoin critic, for participating and highlighted his willingness for dialogue.

Schiff began his arguments by defending tokenized gold, explaining how this digital version of the precious metal retains its fundamental properties, while becoming more transferable and divisible.

According to Schiff, tokenized gold even improves the monetary characteristics of the physical version. He explained that, upon receiving the tokens, they can be deposited in any portfolio or exchange, acting as evidence of ownership of the yellow metal stored in vaults.

And unlike physical bars, the token allows you to transfer all or part of the ownership of gold to another person immediately, functioning as a divisible monetary unit backed by the metal.

CZ responded by pointing out that although bitcoin is not backed by a physical asset, its value lies in the transparency of its protocol. «Bitcoin derives its value from trust, from faith. If people think it has value, then they are willing to buy it (…)». He also added that, unlike gold, “we know how much BTC there is and where it is.”

The issuance of bitcoin is halved every four years at the halving. The process will end around the year 2140 when the limit of 21 million units is reached. Therefore, it is seen as an asset with programmed shortages. On the other hand, it is not known how much gold capacity there is in the world to mine.

The discussion also addressed the tangibility and utility of both assets. Schiff—who a few weeks ago, as CriptoNoticias reported, considered that bitcoin’s performance in 2025 has left much to be desired—insisted that Gold has intrinsic value, backed by its physical properties and industrial demand.

«Gold has properties that other metals do not have and it is necessary. There are industries that need gold, they must buy gold (…). But gold does not fade, it does not lose any value over time. The gold that was mine 10,000 years ago is still here.

The former CEO of Binance replied, clarifying that bitcoin’s intangibility does not mean absence of valuecomparing it with widely accepted digital spaces such as Google or Twitter: «The Internet has nothing physical (…). But X is worth a lot of money, right? It has value. So, it does not mean that bitcoin, because it is virtual, has no value.

Between speculation and trust

The conversation escalated when Schiff cast doubt on bitcoin’s functionality as real money, arguing that its use remains primarily speculative.

«You can’t do anything with it. It has no use beyond the fact that yes, I can transfer it to you, and you can transfer it to someone else(…). To me, people store bitcoin because they think it will be more valuable in the future. “As soon as that expectation fades, then they don’t want to have it anymore,” he said.

When asked if he thinks young people prefer bitcoin or gold, Schiff stressed that they will surely opt for the metal, especially those who have lost money with BTC. He stressed that experiencing losses at an early age allows one to learn the lesson without putting greater assets at risk in the future.

However, Zhao questioned this by highlighting the historical evolution of bitcoinpointing out that its price went from being almost zero in 2010 to exceeding 120,000 US dollars (USD) this year. He then asked the audience how many had made or lost money on this investment, and many hands went up indicating that they had made a profit.

Faced with such a maneuver, Schiff counterattacked by asking the public how many had managed to sell their bitcoin and realize their returns. This time only a few hands remained in the air.

The broker, who is CEO of Euro Pacific Capital, exclaimed that When it comes to BTC, the profits are concentrated in the first buyers. He stated that he knows several of those people and that some are his neighbors. For Schiff, those who acquire today usually lose money.

The practical use of bitcoin

Amid the energetic back and forth, the debate did not end there. Zhao sought to show the practical value of BTC in everyday life, sharing the case of a user in Africa who told him that it previously took three days to pay for a service, walking far from his home to a payment point and returning.

Thanks to access to cryptocurrencies, the person now can complete the same operation in just three minutessomething that cannot be done with gold. This also becomes more relevant when it comes to international transactions without the need to go through intermediaries.

From this example, CZ explained that, although the use of bitcoin as a direct currency remains limited, there are tools such as cards linked to cryptoassets that allow you to pay in dollars while the system automatically converts BTC.

In this way, he clarified that this mechanism solves the barrier to acceptance by businesses and demonstrates how the creation of Satoshi can function as a practical version of “digital gold”, even compared to other tokenized assets.

Although there was no clear winner, the audience of cryptocurrency enthusiasts was left with a debate full of different points of view. On the one hand, Schiff defended the tangibility and productive utility of gold, highlighting the historical trust it has had as a store of value.

On the other hand, CZ highlighted bitcoin’s innovation, its transparency and its resistance to centralized manipulation as an improved form of the metal. Thus, they left the audience reflecting on which of these two assets could best represent the money of the future.

Leave a Reply