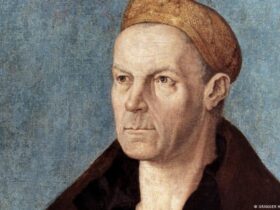

For Gerald Wiesel, founder and CEO of Hamburg, Germany-based aviation consulting firm Airborne Consulting, the recently announced ticket tax cut for airlines operating in Germany “will not reach passengers” because it is “purely symbolic.”

“The state is giving up revenue, but passengers will not get any tax cuts,” Wiesel predicted in an interview with DW.

Although airlines will save about €15 ($17.5) per ticket – potentially up to €50 in some fare categories – dynamic pricing systems mean those savings are unlikely to show up on customers’ bills, he said.

Wiesel argues that aircraft shortages, not fees, are driving airlines’ decisions to reduce services to Germany.

Low-cost carriers such as easyJet and Ryanair have cut their networks because “they simply don’t have the planes they need,” he said, adding that complaints about Germany’s high airport fees distract from the deeper structural issue.

Government aviation slightly reduced tax burden

In November, the German government announced plans to roll back aviation taxes to pre-May 2024 levels from July 1, 2026 – a move based on a coalition agreement between the ruling coalition of the conservative CDU, its CSU sister party and the Social Democrats (SPD).

Depending on the distance of the route, each ticket will be reduced by €3 to approximately €13.

The aviation sector, which has long warned that Germany was pricing itself out of competition, welcomed the move. Joachim Lang, CEO of the German Aviation Association (BDL), called it “an important sign” that ends “years of rising taxes and fees.”

He said state-imposed space costs would fall by about 10%, while he stressed that more relief would be needed if Germany is to benefit from Europe’s post-pandemic air travel boom.

Traffic improvements have gained momentum

That surge is already visible in airport data. Passenger traffic across Europe to grow by 7.4% in 2024 According to industry association Airports Council International Europe (ACI)Exceeded levels seen before the COVID-19 pandemic for the first time. Volume is also increasing in Germany.

Data compiled by the German Federal Statistics Office (Destatis) shows that 81 million passengers subject to aviation tax traveled in Germany last year – a big increase from 62 million in 2022, but still below the 96 million recorded in 2019.

However, tax revenue has exceeded recovery, as income from the aviation levy has almost doubled since its introduction in 2011, rising from €963 million to €1.88 billion last year.

“The aviation tax has become a fixed part of budget planning not only in Germany but throughout Europe,” said Frank Fichtart, an expert on tourism and transportation at the Worms University of Applied Sciences in Germany.

He said revenues generally flow into the national treasury, which is why it is possible to reduce taxes, but “compensation must come elsewhere” – a tall order given strained government finances.

Old fleet, increasing demand

While traveler taxes are “an important factor,” Feichert said they are “not the only factor affecting the attractiveness of a location.” Along with taxes, airlines are also facing increasing operational headaches, he said.

a fresh Aviation industry group IATA reports It has warned of a “record high” backlog (cumulative number of unfulfilled orders) for new aircraft of 17,000 planes globally.

“At the current delivery rate, it will take 14 years to complete, which is twice the average backlog of six years for the period 2013-2019,” the report said.

The report said the average age of the global commercial aircraft fleet has reached 15 years – the highest in aviation history – while the industry is also struggling with a long-term pilot shortage.

The crisis is hitting Europe’s budget carriers particularly hard, Wiesel told DW. Ryanair has approximately 400 aircraft on order – 100 for replacement and 300 for development. “The same applies to EasyJet.”

He argues that until those deliveries are completed, airlines will “concentrate precious capacity where profitability is highest.”

German airports hit by airline cuts

While the two budget airlines have cautiously welcomed the German aviation tax cut, their strategies are already reshaping the market.

In January, Ryanair will cut 76 of its 246 weekly flights to Berlin and eliminate 44 routes from Cologne.

EasyJet plans to increase seat capacity by only 2-4% in 2026 – well below its group-wide target of around 7%.

Germany remains Europe’s largest aviation market – too big for the major carriers to ignore. Wiesel predicted that when the aircraft backlog was resolved, “Ryanair will be back.”

“It will not leave [German flag carrier] Lufthansa with its own field,” he said.

This article was originally written in German.

Leave a Reply