Gold exceeds $4,500 per ounce while the dollar registers its worst annual decline since 2017.

The community debates: “bitcoin has risen 89,000 times since Schiff was told to buy it.”

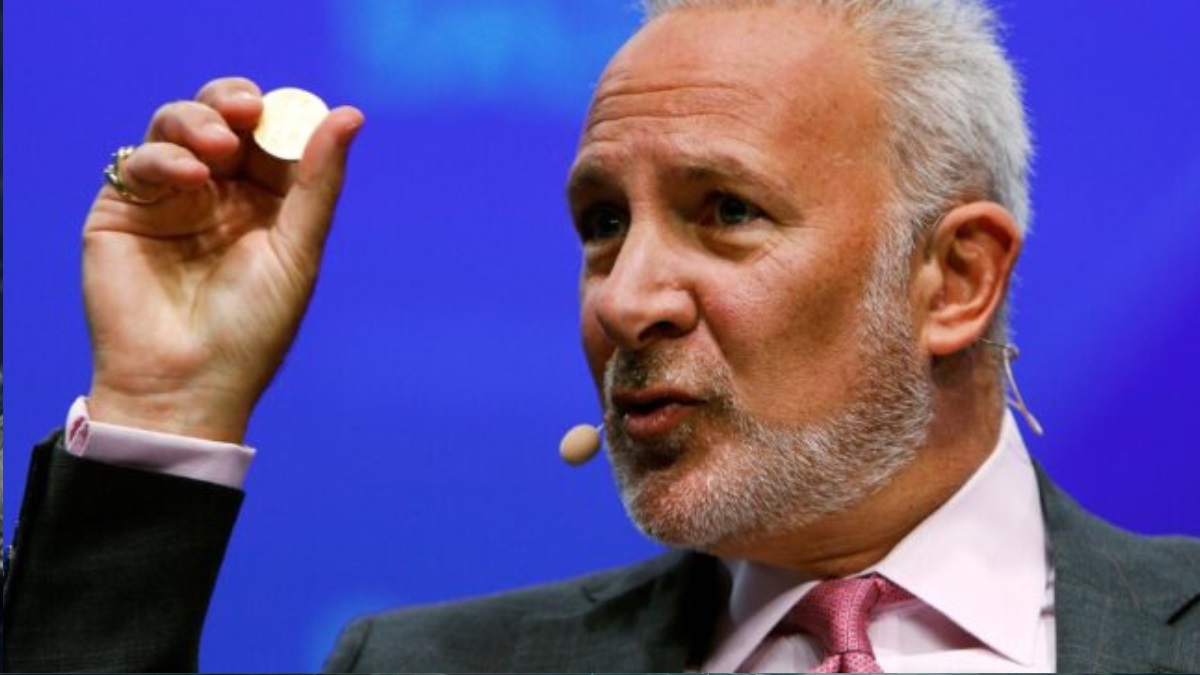

American economist Peter Schiff claims that the United States is heading towards an economic collapse of historic proportions. As he sees it, the world is witnessing the end of the “exorbitant privilege” of the dollar, a change of era where gold, and not bitcoin (BTC), will consolidate itself as the undisputed reserve asset of central banks.

“Prepare for a historic economic collapse,” pointed out Schiff. His words coincide with an exceptional year-end for precious metals, where gold surpassed the barrier of the 4,500 dollars per ounce, accumulating an increase of 70% in 2025 alone, while silver touched $75.

This metals boom occurs in a context of weakness for the US currency. The dollar index (DXY) remains close to 98 points, with a fall of 9.7% for the year—its worst performance since 2017. Schiff attributes this trend to the persistence of inflation above the Federal Reserve’s 2% target. Something that — according to him — gradually erodes the value of the dollar and generates an “unpleasant surprise” for traditional investors in stocks, bonds or dollar deposits, who see them lose purchasing power. As a result, many turn to precious metals as a refuge.

The economist does not consider bitcoin an asset capable of displacing the dollar or gold as a store of value. On the contrary, it is once again fueling the controversy with new criticism of the currency created by Satoshi Nakamoto. According to Schiff, the BTC investment opportunity has already concluded and predict a gradual fall towards absolute zero for those who still maintain the asset.

However, its credibility in the digital world is under question. Social media has been quick to remind him of his history of failed predictions. “Like you said bitcoin would crash when it was at $3,500 and you told everyone not to buy it?” recriminated a user.

Criticism of Schiff has become a genre in itself under the motto of the “reverse Schiff.” It is the ironic theory that his negative predictions for bitcoin are usually bullish signals.

«That Peter Schiff predicts an economic collapse is the most reliable bullish signal that bitcoin has. “It’s like a clock,” pointed out another user. The term “Schiff signal” also appears recurrently replicating his comments on X, making it a recurring and established meme.

Bitcoin: safe haven or risk asset?

In this dialectical dispute, Schiff has found an unexpected ally in the macroeconomic analyst Henrik Zeberg, although for different reasons. Zeberg agrees that bitcoin will not act as a lifeline in a real crisis. «Bitcoin is not a special asset. It is a risk asset. In fact, a highly risk-prone asset,” Zeberg stated as recently reported by CriptoNoticias.

According to the analyst, bitcoin thrives only on the abundance of liquidity. “Bitcoin will fall with risk assets instead of acting as a safe haven,” warns Zeberg. Suggests that digital currency could plummet below $10,000 If the “everything bubble” ends burstbehaving more like a speculative technology stock than the “digital gold” that many defend.

Zeberg, in his analyses, does not show rejection of the asset itself, but sees bitcoin as part of a larger macro cycle, where the “blow-off top” (final phase of parabolic rise) inevitably precedes the collapse in the bearish/recession phase.

In a context of global uncertainty, Schiff’s warnings reflect a view shared by some analysts that the international financial system, as we have known it, could be undergoing significant structural change.

Leave a Reply