Banking Stocks: There is a lot of volatility in the market at this time. Talking about Nifty Bank, it had reached a record high of 53300 in July but then it slipped under the pressure of profit booking. Currently, it is down by more than two and a half percent from its high. However, there was a lot of difference in the speed of decline in government and private banking shares. According to the data, the Nifty index of government banks i.e. Nifty PSU Bank has fallen 16.61 percent from its record high while Nifty Private Bank has fallen by 2.16. Nifty Bank is down 2.66 percent from its record high.

Now if we talk about individual stocks, at this time there is more scope for growth in the stocks of private banks than in the stocks of public sector banks. According to the target price fixed by analysts for investing in the shares of banks, a return of up to 65 percent can be achieved by investing in the shares of private banks and up to 50 percent by investing in the shares of public sector banks. At the same time, there are three private banks which not a single analyst covering them has advised to sell.

Which Nifty Bank stocks have the highest earning potential?

Related news

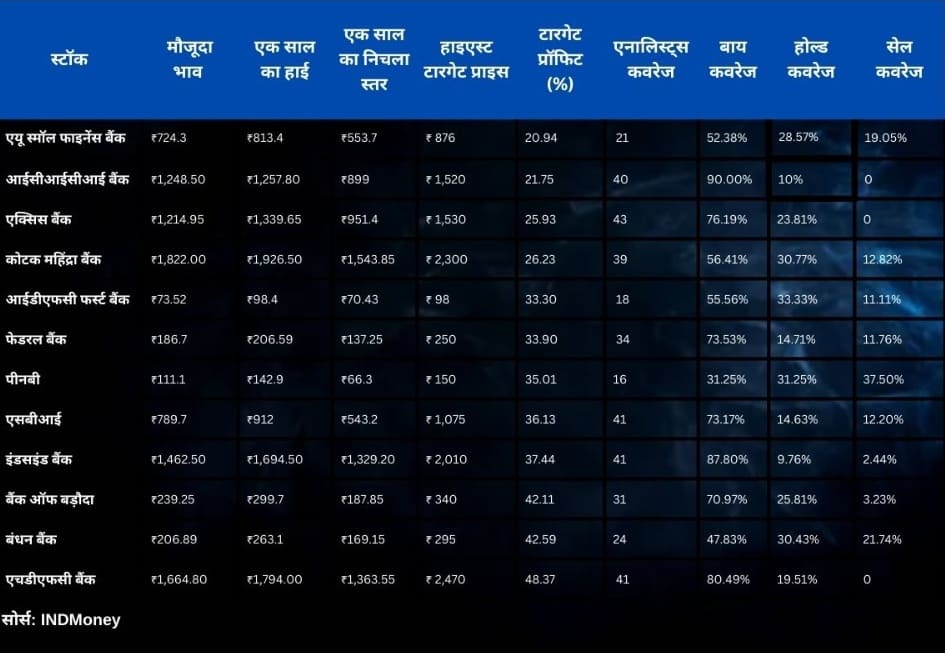

HDFC Bank has the highest upside potential among the 12 Nifty Bank stocks from current levels. Out of the 41 brokerages covering it, the highest target price is Rs 2470 which is 48.37% upside from current levels. On the other hand, there are three Nifty Bank stocks which have not been given a sell rating by any of the analysts covering it and these stocks are HDFC Bank, ICICI Bank and Axis Bank. Note that all these are private sector banks. Here are the details of all Nifty Bank stocks including current price, one year high-low price, target price along with how many analysts are covering them and how many have given buy, how many have given sell and how many have given hold rating.

Which share is strong among public and private banks

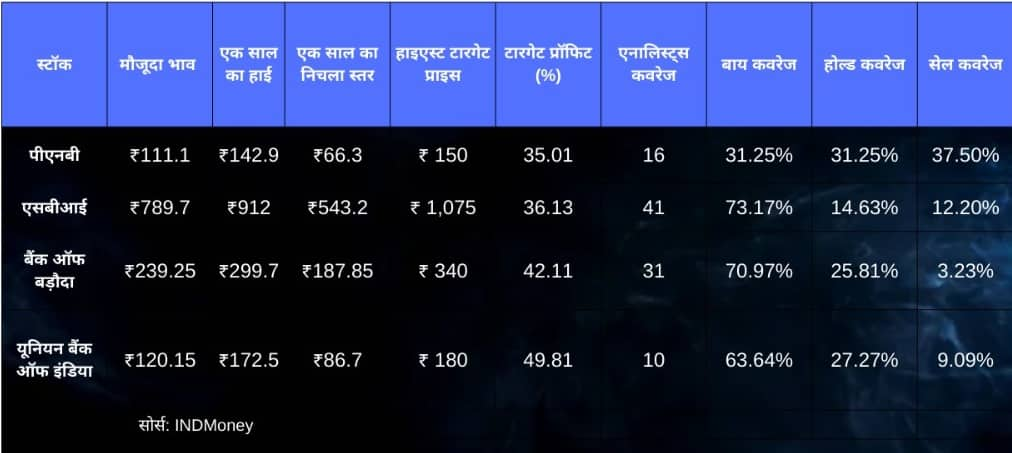

Many analysts have given their views on 4 out of the 12 stocks listed in Nifty PSU and among these, brokerages are most bullish on Bank of Baroda and SBI. More than 70 percent of the analysts covering these two have given them a buy rating. According to the highest target price given by analysts, about 50 percent profit can be earned from Union Bank of India and 42 percent profit can be earned from Bank of Baroda by investing at the current level.

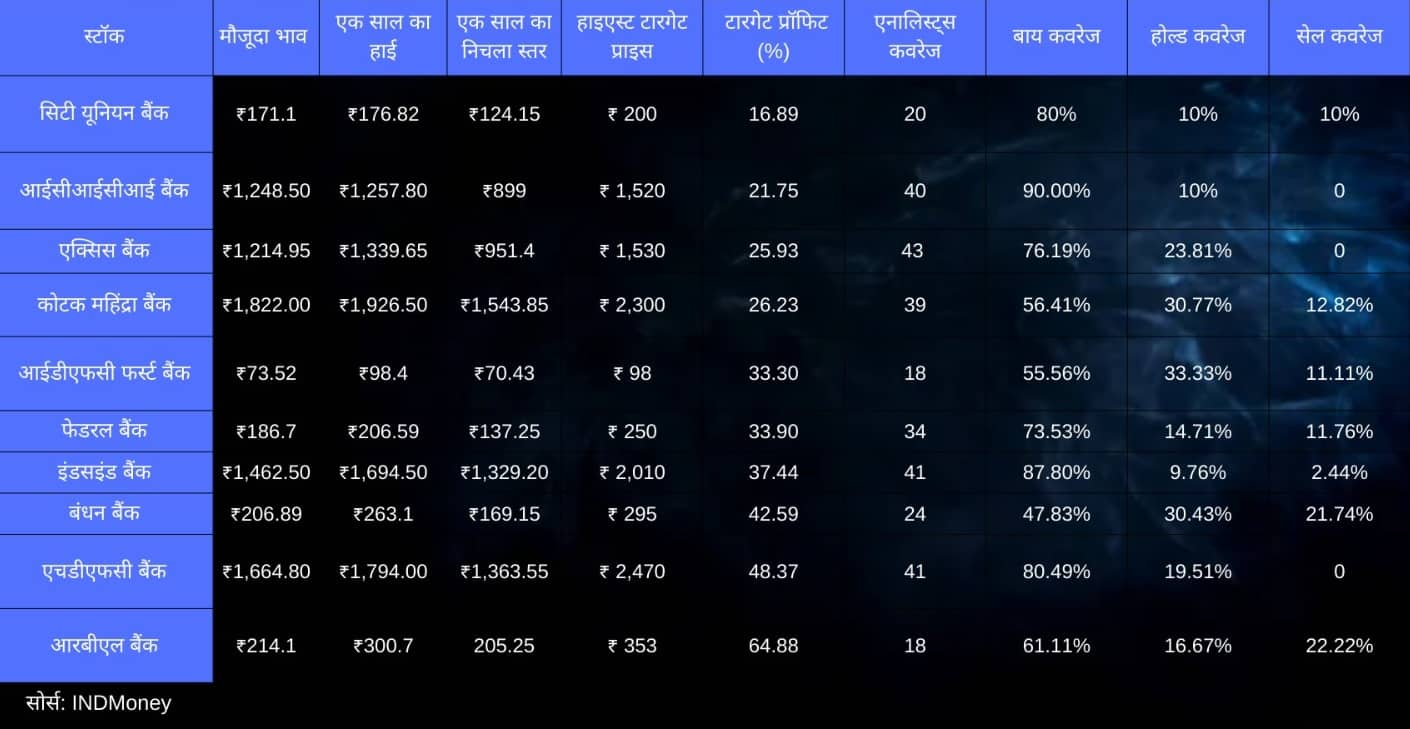

Now let’s talk about private banks. Out of 10 Nifty Private Bank stocks, no analysts have recommended selling three stocks – HDFC Bank, ICICI Bank and Axis Bank. At the same time, the biggest profit can be obtained by investing in RBL Bank, whose highest target price is about 65 percent upside from the current level.

Nifty Bank, Nifty Private Bank and Nifty PSU Bank figures

Nifty Bank is currently at 51938.05 and hit a record intra-day high of 53,357.70 on July 4, 2024. Nifty Private Bank closed at 26,075.55 and Nifty PSU Bank at 6,715.3 at the close of trading on September 13. Nifty Private Bank closed at 26,653.55 intra-day on July 4 and Nifty PSU Bank hit a record high of 8,053.30 on July 3, 2024.

(Current price is the closing price of September 13 on NSE.)

231% jump in 11 months, record high for two consecutive days, this stock of Rekha Jhunjhunwala still has power

A new guest in Ashish Kacholia’s portfolio, has increased the capital 5 times, have you also invested money?

Disclaimer: The advice or views expressed on Moneycontrol.com are the personal views of the experts/brokerage firms. The website or management is not responsible for the same. Moneycontrol advises users to always seek advice from certified experts before making any investment decision.

Leave a Reply