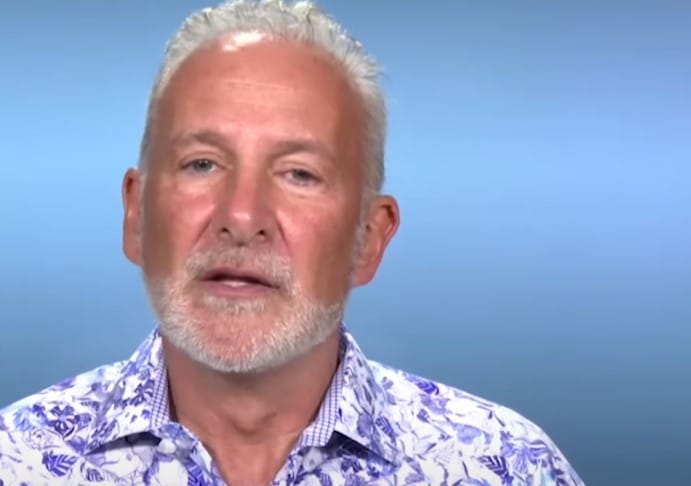

Following the announcement of the Federal Reserve’s interest rate cuts, American economist Peter Schiff predicts a bleak future for the US economy.

Schiff explained his position through from a message in X with which he warned about a deeper recession and rising inflation which –in his opinion– will put the United States government in check.

“As expected, the Federal Reserve caved to the markets and cut interest rates by 50 basis points,” he wrote. He added that this level of cuts will not prevent that problems resurface, above all “in an economy that is just cooling off.”

The economist believes that the Fed’s measure It is a mistake of monetary policy, Since rate cuts typically involve a return to what is known as “quantitative easing” (QE). Quantitative Easing).

This defines a series of economic measures that seek greater liquidity by encouraging greater spending by the private sector and facilitating access to credit from the banking system. These include cutting interest rates.

“Analysts who say the stock market is not pricing in a recession because it is trading near all-time highs still don’t get it,” he said, before pointing out that investors know that while quantitative easing often drives market gains, It is an indicator of recession.

In that regard, Schiff called attention to the rise of assets such as gold, which reached new historical highs. Even so, he foresees an upcoming rebound in inflation and Very negative effects on the US dollar.

The Fed’s 50 basis point interest rate cut not only pushed gold to an all-time high above $2,595, but also caused the US dollar to plunge below 0.84 Swiss francs, a new 13-year low. What should be even more worrying is that long-term Treasury bond yields rose. It’s game over for the Fed.

Peter Schiff in X.

With these statements Schiff, known for being one of the main skeptics and critics of bitcoin (BTC), reiterates the position he has held for several months. Time in which he comes questioning the economic plan outlined by Fed Chairman Jerome Powell.

As CriptoNoticias has reported, the economist constantly talks to his followers about the financial problems of the US. His negative view has even led him to to advise that “they should not buy dollars”«.

Schiff believes that the currency will surely lose value due to “government incapacity.” He therefore recommends not being carried away by the “optimism” shown by the Fed, while the country’s economy “is weakening at the same time that inflation is strengthening.”

Schiff’s fears of an impending recession add to warnings from JPMorgan CEO Jamie Dimon that the economy is heading for something more serious: stagflation.

Although the JPMorgan CEO’s comments were made shortly before the Fed announced the rate cut, it seems that – like Schiff and Dimon – there are many who They still fear dark outcomes. Hence Powell’s recent statements after making the announcement, calling for calm and assuring that a recession is not looming.

Leave a Reply