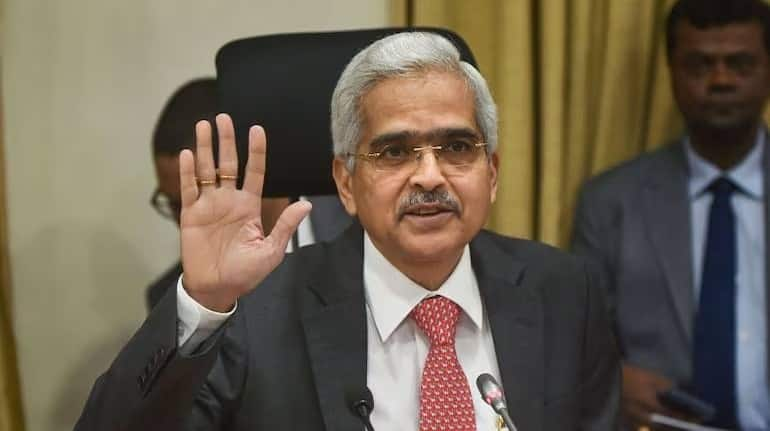

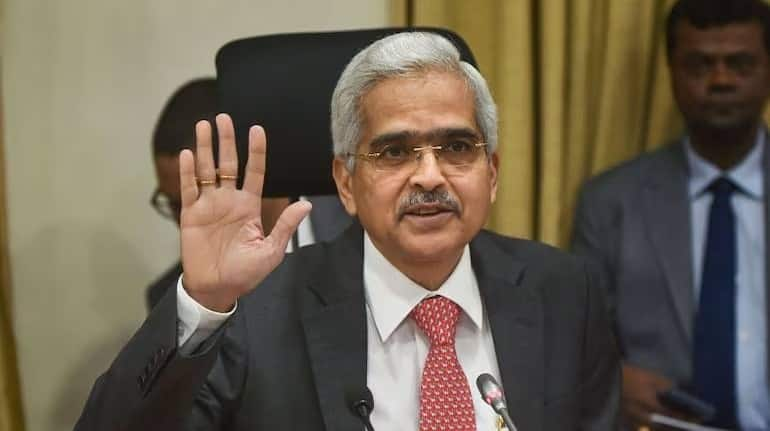

People waiting for cheaper home loans and car loans may be a little disappointed. Reserve Bank of India (RBI) Governor Shaktikanta Das has given a big statement on October 18 regarding the reduction in interest rates. He said that it would be premature and very risky to reduce interest rates now. Due to this, there is no hope of reduction in repo rate in December. Earlier this month, RBI did not reduce the repo rate in its monetary policy.

Interest rates were expected to decrease in December

It was believed that the Central Bank (rbi) may reduce the repo rate in its monetary policy in December. The Monetary Policy Committee (MPC) meeting of RBI is scheduled to be held in the first week of December. MPC (MPC) meets once every two months. But, after the statement of the Central Bank Governor on October 18, the interest rate (Interest Rate) is no longer expected to occur.

Shaktikanta Das gave reason for not reducing the rate

Shaktikanta Das said in a conversation during an event in Mumbai, “We are not lagging behind in taking decisions. There has been no impact on India’s growth story. India’s growth will be 7.2 percent. Growth is continuing, inflation is in decline.” It is also coming down, although there are some risks. Therefore, reducing interest rates now would be hasty and very risky.” He said inflation is likely to decline, but there are some ‘big risks’ to its outlook.

RBI’s focus on bringing inflation under control

RBI did not change the repo rate in its monetary policy presented in the beginning of October, but it did change its stance regarding monetary policy. Had changed its stance from ‘Withdrawal of Accommodation’ to ‘Neutral’. RBI Governor Shaktikanta Das had already made it clear that his focus will remain on bringing retail inflation under control.

Retail inflation rises again in September

Retail inflation increased again to 5.5 percent in September. In the previous two months it was below 4 percent. The increase in inflation in September is being attributed to the rise in prices of food items. Food inflation increased to 9.24 percent in September. In August it was 5.66 percent. It seems that the surge in inflation in September has had an impact on the prospects of interest rate cuts.

Also read: Kotak Mahindra Bank to acquire personal loan book of Standard Chartered Bank

The US central bank had reduced the interest rate in September

Das had earlier said that he would keep in mind the condition of the Indian economy before reducing the interest rates. In September, the US central bank Federal Reserve reduced the interest rate by 50 basis points. After this, it was believed that the central banks of other countries including India would also reduce the interest rates. But, in its monetary policy presented earlier this month, RBI did not change the interest rate for the 10th consecutive time.