Investing 60% in stocks and 40% in bonds is a classic recommendation from financial advisors.

For Kiyosaki, that recommendation has not made sense since 1971.

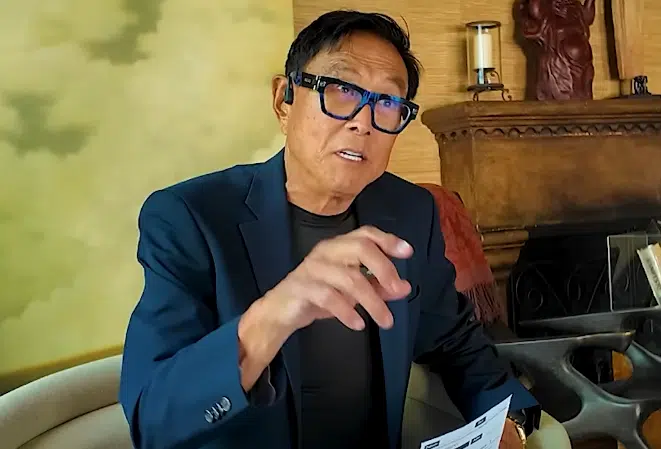

Robert Kiyosaki, the author of the book “Rich Dad, Poor Dad,” expressed through his X account that the “60/40 nonsense of financial planners is dead.”

The 60/40 investment formula is a traditional strategy that allocates 60% of the portfolio to stocks to seek growth and 40% to bonds to provide stability and reduce risks.

Although it is a classic recommendation of financial advisors, for Kiyosaki “that silly relationship died in 1971, the year in which [el presidente de Estados Unidos] Nixon took the dollar off the gold standard.”

This turned the dollar into fiat money, whose value was no longer backed by gold reserves, and allowed the United States to print money without limitsas explained by CriptoNoticias. This brought a change in the stability of traditional markets.

In his publication, Kiyosaki poses: “Who would be stupid enough to buy bonds (debt) from a bankrupt country? The truth is finally coming to light. Morgan Stanley now promotes 60/20/20, a more stable path to financial security and freedom in the future.”

That is, 60% in stocks and the remaining percentages in bonds and gold. “The facts are that gold has outperformed stocks and bonds for years, but no one said anything,” he added.

In this context, Kiyosaki highlights the strength they are showing gold, silver, bitcoin (BTC) and ether (ETH), Ethereum’s native cryptocurrency.

This reflects Kiyosaki’s view that assets such as precious metals or BTC can offer protection against inflation and the constant devaluation of fiat money. It is because they have characteristics (such as their scarcity) that make them function as a store of value in times of economic turbulence or geopolitical tensions.

Leave a Reply