Bitcoin (BTC) faces the most marked episode of capitulation of the current cycle, with a visible increase in loss-selling among short-term investors. These movements, according to on-chain analysts, could anticipate a major market turnaround or, in the worst case, the ...

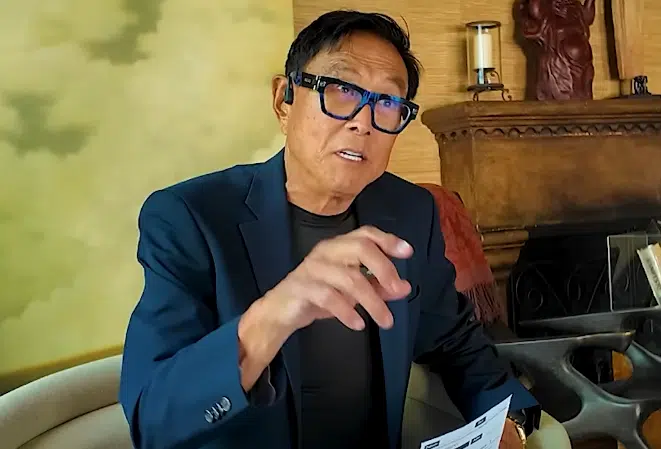

“AI creates fake people the same way the FED creates fake money,” Kiyosaki says. The writer says that he preferred that they invent other types of lies about him. Investor Robert Kiyosaki warned about the circulation of a video manufactured ...

Bitcoin (BTC) fell this week below $90,000, a move that erased all gains accrued in 2025 and is causing concern among traders. The depth of the pullback leads some market players to question whether a new “crypto winter” has begun. ...

Bitcoin (BTC) reached reactivated demand levels this week, as has happened in the past. The digital asset fell below $90,000, in a downward movement that has been developing for several weeks and that now coincides with technical and on-chain metrics ...

“Few can afford a $100,000 Bitcoin,” says Kiyosaki. Instead of bitcoin, he recommends buying silver, which is cheaper. Entrepreneur and author Robert Kiyosaki once again referred to the bitcoin (BTC) market and cryptocurrencies with a message focused on economic accessibility. ...

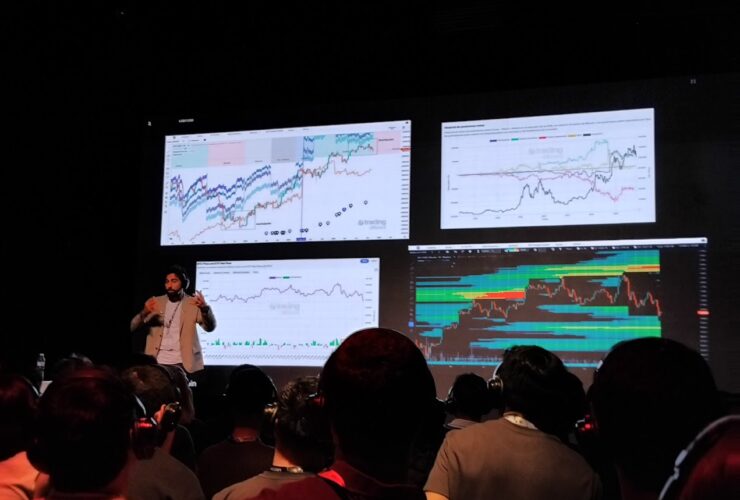

“There has never been a bear market without a prior altseason,” says analyst Javier Espasa. Trader Emanuel Juárez identifies supports between USD 84,000 and USD 80,000. The recent drop in bitcoin (BTC), back to around $95,000, has sparked concern among ...

Iván Paz Chain does not agree that the 4-year cycles for bitcoin are over. Being profitable in trading is possible, but only with good preparation and adequate tools. Bitcoin (BTC) and cryptocurrency trading is a minefield of myths, unrealistic expectations, ...

For Willy Woo, there are errors of interpretation in on-chain metrics. According to other analysts, bitcoin changes hands from old whales to institutions. While the price of bitcoin (BTC) remains above USD 100,000, a new debate is opening up among ...

“I follow the laws of money, the laws of Gresham and Metcalf,” says Robert Kiyosaki in the tweet he published on November 9, where he reiterates his practice of buying assets other than fiat money. It also launches new predictions ...

American investor Ray Dalio, founder of Bridgewater Associates, warned that the recent decision by the Federal Reserve (FED) to stop quantitative tightening (QT) and prepare the return of quantitative easing (QE) is an unequivocal sign of the end of the ...