Mfi shares: RBI has given great relief to NBFCs. The risk weightage on the loan given by banks to NBFCs has been reduced from 125 per cent to 100 per cent. This means that some time ago on the high ...

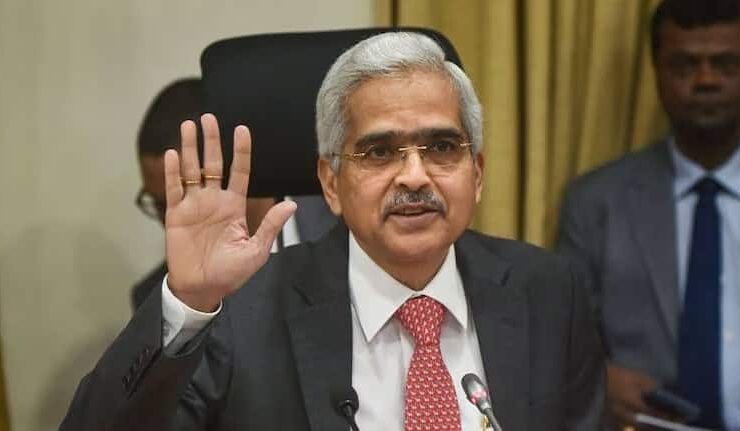

People waiting for cheaper home loans and car loans may be a little disappointed. Reserve Bank of India (RBI) Governor Shaktikanta Das has given a big statement on October 18 regarding the reduction in interest rates. He said that it ...

The trend of Unified Payment Interface (UPI) has increased rapidly in India. People are using UPI app even for making small payments. Be it big transactions or big money transfer work, UPI is becoming the first choice of the people. ...

Yes Bank Stake Sale: The matter of stake sale in Yes Bank has stopped for now. The Reserve Bank of India (RBI) is uncomfortable with the majority stake of Yes Bank going to a foreign bank. People familiar with the ...